First Half Re-cap | The Importance of Starting Early | Glacier Advisors of Raymond James Outlook

First Half Recap

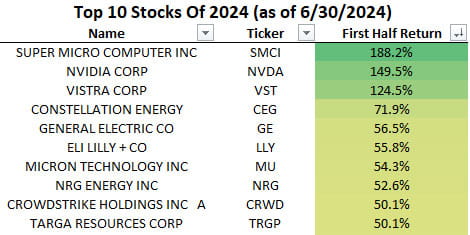

Top Performers

The 2024 market is off to a roaring start. The S&P 500, measured by the ETF SPY, climbed 15.4% before dividends. Lead by NVIDIA, the semiconductor manufacturer saw its market value briefly exceed both Microsoft and Apple - becoming the most valuable company in the world. Super Micro Computer (symbol: SMCI) topped the S&P 500s list of top performers in the first half. The company is also tied to the AI boom. Also of note, Eli Lilly continues to perform well with its weight loss division growing and top selling diabetes drug, Trulicity, boosting sales.

Concentrated Performance

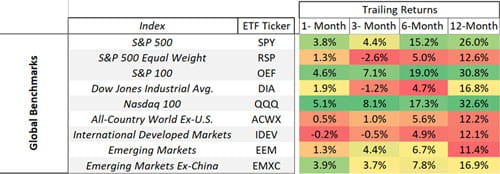

The S&P 500 is a Market Cap Weighted index. Meaning, the S&P 500 favors larger companies over smaller companies when calculating performance. The S&P 500 Equal Weight Index looks at all companies evenly. comparing the performance between the S&P 500 and the Equal Weight Index helps investors understand if the market rally is widespread, or if the gains are concentrated among the largest companies. The chart below shows notable outperformance of the S&P 500 (symbol: SPY) over the S&P 500 Equal Weight (Symbol: RSP). The S&P 500 outperformed the equal weight by over 11% in the first half. This tells us that a select few large stocks, including NVDA, are driving the market’s performance. The weaker performance of the Equal Weight Index tells us the rally is not widespread.

Source: FactSet

Global Performance

The U.S. Markets continue to dominate the global landscape. Both the S&P 500 and the Nasdaq 100 produced returns more than double their international conterparts. More recently, emerging markets are showing signs of strength.

Source: FactSet, Glacier Advisors of Raymond James

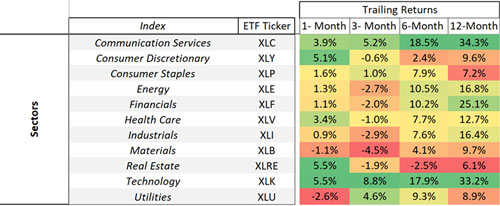

Sector Performance

Lead by the artificial intelligence boom, Communication Services and Technology lead sector performance. Economically sensitive sectors like Industrials, Energy and Materials weakened over the past 3 months.

Source: FactSet, Glacier Advisors of Raymond James

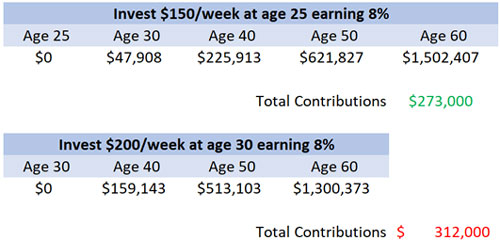

The Importance of Starting Early

It’s no secret that the earlier someone starts investing, the better outcomes they’ll experience. We encourage people to have conversations with the 10-, 20- and 30-year-olds in their life. Small amounts now mean big wealth later. For most, establishing generational wealth doesn’t happen overnight. It takes two things: 1. Time 2. Discipline.

Educate the younger workforce now and build wealthier generations to come.

Example:

Look at two investors. Investor A starts saving $150 per week at age 25 and investor B starts saving $200 per week at age 30. Assuming both earn the same return and save until they turn 60, Investor A attains a larger portfolio value then B while contributing less over their lifetime. Start early!

Source: Glacier Advisors of Raymond James

5 Things to Watch for the Second Half

- Housing Affordability – half of all renters spend more than 30% of their income on housing, according to CNBC. This is considered cost burdened and could hurt consumer spending numbers in the second half of the year.

- The AI Boom – Companies mentioning AI are seeing stock price gains. Will the revenue growth and earnings of these corporations be enough to support lofty stock valuations?

- Interest Rates – the Federal Reserve members are all over the board on this topic. No one seems to know when rates will drop. The good news… rates are not expected to climb higher.

- Commercial Real Estate Crash – this isn’t in headlines, but it’s happening. Estimates have commercial real estate valuations down anywhere from 30-50% depending on location. Our team will monitor any potential contagion from this market into others.

- What We Like – given the high interest rate environment, sketchy political landscape, and cracks in the economy, healthy growth and dividend paying stocks, short term bonds, and real assets continue to look attractive to our team.

Scott Miller, Senior VP – Investments

Brett Miller, CFA, CFP®, Financial Advisor

Any opinions are those of Scott Miller and Brett Miller, CFA, CFP® and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained in this material does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The NASDAQ-100 (^NDX) is a stock market index made up of 103 equity securities issued by 100 of the largest non-financial companies listed on the NASDAQ. It is a modified capitalization-weighted index. ... It is based on exchange, and it is not an index of U.S.-based companies. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, and CFP® (with plaque design) in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.