Market Commentary / Q3 2024

INVESTOR COMMENTARY

Forecasts and predictions are pervasive in markets and are often a reflection of current sentiment, but in our experience, they have proven to be a reliably inaccurate tool for investors. This is a good lesson to remember as markets search for direction in the midst of election season, and pundits are more than happy to voice their opinions.

The good news is we do not recommend investing based upon what may or may not occur tomorrow, and certainly not upon unfiltered opinions. We believe investing where there is potential intrinsic value, in strategies with durable characteristics to weather inevitable volatility that comes with building wealth which has served investors well over time.

Throughout 2023, economists projected the U.S. to be in a recession by early 2024, putting investors on high alert. But the economy continued to grow, albeit at a slower pace. The job market has weakened in recent months, but unemployment remains low. The same economists’ forecasts called for the Federal Reserve to begin cutting rates earlier this year as well. The anticipation of rate cuts increased market volatility, as investors anxiously awaited the first cut and questioned what that meant for markets and the economy.

On September 18th, the Fed finally lowered rates, and despite being well telegraphed, markets responded favorably as the market welcomed greater clarity. Change and uncertainty naturally leads to questions, and with the election nearing attention is now focused on politics. Our team has experienced ten Presidential elections and 20 Congressional elections, and throughout each of those events we have been asked the same questions: “What impact the election will have on portfolios and the market?”; and, “How should we position our portfolios based on a potential outcome?” Our response today remains resolute — do not make drastic portfolio changes based upon an election outcome. We are not dismissive of the importance of elections, and the opportunity for the electorate to cast their votes; however, history shows markets perform well regardless of which party wins, assuming we have a divided government – whereby one party does not control the White House and both bodies of Congress. Certainty is what markets seek more than outcomes, which is often why resolving the election is of greater impact to markets than which candidate actually wins. Campaigning has a tendency to generate policy positions and proposals with an extremely low probability of coming to fruition. Today, proposals related to tax policy are center stage and suggest more extreme changes by either party that are not likely to occur assuming we maintain a divided body of government.

From an investing standpoint, we believe tax efficiency should always be top of mind when allocating your portfolio. Long-term capital gains and qualified dividends are both taxed at preferential rates compared to ordinary income. For example, the current capital gains tax rate for a couple filing jointly with ordinary income up to approximately $530k is just 15%, compared to a 35% ordinary income rate. No one likes paying taxes, however we typically encourage investors to consider opportunities to rebalance, capturing losses and/or locking-in long-term gains as we seek to minimize tax implications. Furthermore, we tend to favor more tax efficient investments such as ETFs and SMAs, when appropriate for our clients.

MARKET COMMENTARY

The stock market’s strong first half of 2024 returns, +15.3%, were driven by a concentrated number of large technology companies. In the third quarter, markets are again currently higher (+4.8%), but with only a few days remaining in the quarter, the Technology sector was on pace for its worst relative quarter since 2Q16. So far, the third quarter has seen returns broaden, with 10 of the 11 sectors enjoying year-to-date gains of 10% or more. Another example of the market’s improving breadth, is seen by the S&P 500 Equal Weight Index’s outperformance in the third quarter after lagging the market cap weighted S&P 500 Index by nearly 8% in the first half of the year. As equity markets have notched new records, earnings expectations have remained high. Double-digit earnings growth expectations in ‘25 and ‘26 create a high bar to hurdle, particularly for a slowing economy. Add in a starting point with a high valuation, and S&P 500 returns over the next few years could be below average. Offsetting forces, such as secular growth tailwinds in AI, weight-loss drugs, and electrification, as well as stimulus, domestically and abroad keep us constructive on equity markets but in a more selective manner. Fortunately, we’re not recommending investing blindly in the index. We favor growth at a reasonable price and dividend growth strategies, where in our opinion valuations are relatively cheaper, growth remains attractive, businesses tend to be more resilient, and returns on capital are meaningfully higher, resulting in more attractive risk and return profiles.

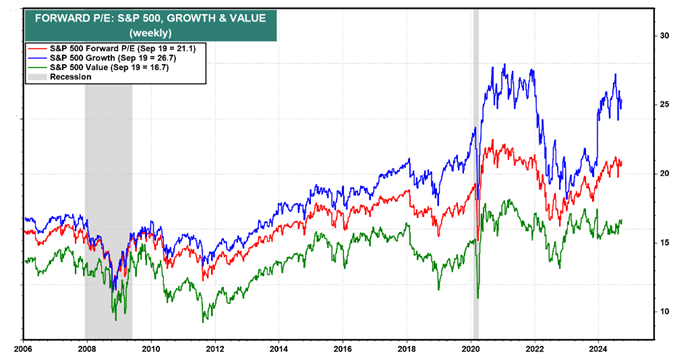

This chart(1) breaks out the current P/E multiple of the “Growth” and “Value” constituents of the S&P 500 Index. The spread between Growth (blue) and Value (green) is the valuation gap where we believe opportunities may exist.

The green line (value) is comprised heavily of companies that pay a dividend to shareholders, many of which are growing those dividends year over year. Dividend growth is a strategy we have embraced for investors seeking income as well as growth. With interest rates falling, we believe dividend stocks (on a select basis) may appear more compelling for income investors and with a rising dividend strategy offer potential income growth over time.

The urge to know what happens tomorrow often leads to poor decision making, when it comes to investing. Whether it’s chasing the latest investment fad or sitting out the market because of an election cycle – investors are well served to find a balance from extreme positions. Our team remains hard at work on your behalf, and we deeply value the trust and confidence you place with us. We look forward to discussing your portfolio and specific goals in the coming weeks, and encourage you to contact us anytime you have a question or general interest.

Any opinions are those of the authors and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

(1)Source: Yardeni Research. You may not invest directly in an index. Indices are shown for informational purposes only and are not a recommendation. Past performance is not indicative of future results. The S&P 500 Index is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The S&P 500 Growth Index tracks the performance of those stocks in the S&P 500 with higher price-to-book ratios. It is a cap-weighted index. This Index includes the effects of reinvested dividends. The S&P 500 Value index tracks the performance of those stocks in the S&P 500 with lower price-to-book ratios. It is a cap-weighted index. This Index includes the effects of reinvested dividends.