Reliable information supports sound decisions

Investment Strategy

by Larry Adam

Chief Investment Officer, Private Client Group

Putting the recent volatility into perspective

March 21, 2025

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Tariff uncertainty keeps the Federal Reserve sidelined

- Weak survey-related data is at odds with actual measures of economic activity

- April 2 is a pivotal date – any clarity could remove cloud of uncertainty

Happy National Countdown Day! Yes, you read that right—today is a day to celebrate the excitement and sometimes anxious anticipation that comes with planning for an upcoming event. Whether the event is big or small, personal or professional, business or entertainment related—it could be anything of significance. There's even an app for that, allowing users to track the countdown in days, hours, and even seconds. Speaking of countdowns, the financial markets are highly focused on what will transpire on April 2—President Trump’s self-declared date when he will disclose his plans for reciprocal tariffs and sector-specific tariffs (e.g., cars). This unpredictability, on top of tariffs already in place, has led to increased volatility as consumer, business, and investor confidence have retreated recently. Below, we discuss how this uncertainty is impacting the Federal Reserve (Fed), businesses, and consumers, and why it is so important to get some clarity.

- Tariff Uncertainty Keeps Fed Sidelined | With trade concerns slowly paralyzing business and consumer purchase decisions, Fed policymakers have revised their 2025 growth estimates downward (from 2.1% to 1.7%) and projected higher core 2025 PCE inflation (from 2.5% to 2.8%) in their latest Summary of Economic Projections. While Chair Powell noted that uncertainty is remarkably high, the Fed remains in a wait and see mode as it awaits the administration’s tariff decisions and potential retaliatory tariffs (which are growth negative), as well as signs of when Trump’s other policy initiatives—deregulation and extension of tax cuts—will roll out (which should be growth supportive). Despite some clouds on the horizon, Chair Powell downplayed the risk of a recession (we agree) and resurrected the term "transitory'' in response to tariff-related inflation. The result: Fed ‘dots’ suggest two interest rate cuts this year (we agree again).

- Soft Data Weak, Hard Data Remains Robust | While survey-related data (soft data) is softening, actual measures of economic activity (hard data) suggest the economy remains on solid footing. Historically, survey data is volatile and often clouded by short-term headlines—a point Chair Powell reiterated in the press conference. That is why we prefer to focus on hard data and real-time indicators.

- Consumers Feelings Versus Actions | Consumer sentiment has been affected by trade policy uncertainties. The University of Michigan Consumer Sentiment Index recently dropped to a ~2.5 year low and there were troubling signs beneath the surface. For example, the % of consumers expecting improvements in their personal financial condition and business conditions fell to record lows. In addition, several retailers lowered their 2025 earnings guidance, noting a slowdown in consumer spending trends through the first quarter. However, some of this weakness may be attributed to one-off factors such as a cold winter and a severe flu season. More importantly, there are emerging tailwinds for consumers, including falling oil prices (down ~16% from recent highs), surging tax refunds (up 20% YoY), and ongoing healthy growth in credit card spending. Any clarity in tariff policy could further support a rebound in consumer spending through the spring.

- Employment Remains Healthy | Consumer surveys haven't been this pessimistic about the labor market in years, with the percentage of consumers expecting improvement declining to its lowest level since 2008. Despite this, jobless claims remain near record lows, and the US economy continues to add ~150k jobs per month. More importantly, our favorite real-time indicator of the labor market, withholding taxes, is up ~9% year-over-year, suggesting job gains should continue. Strong job growth will remain supportive of consumer spending.

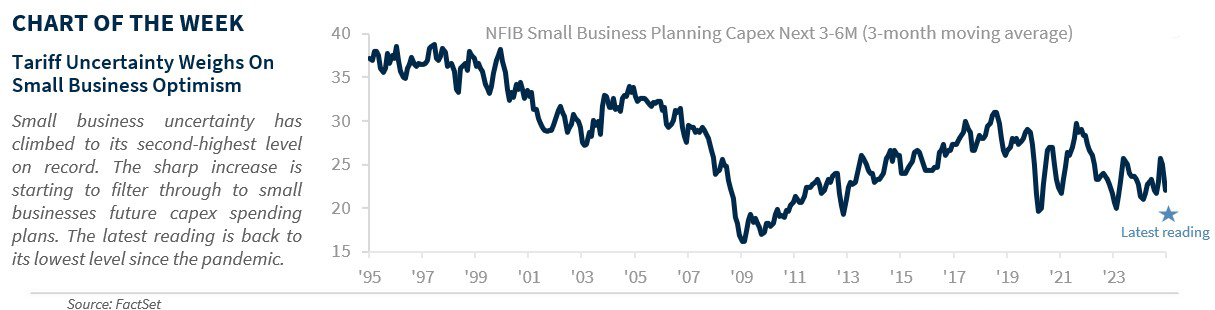

- Business Capex Inconsistency | With the post-election confidence surge fading and uncertainty on the rise, businesses are scaling back their future capital spending plans. The recent NFIB Small Business survey showed capital spending plans falling back down to 2020 lows. In manufacturing, regional Fed surveys indicate significant declines in both new orders and capital expenditure plans. However, this negative sentiment has not been reflected in the actual results. During earnings season, only 13 companies in the S&P 500 mentioned the word 'recession' in their commentary, compared to the five-year average of 80. Additionally, overall industrial production, which measures actual industrial/manufacturing activity, rose to a record high for the first time since 2018 this month.

April 2 Is The Key Date To Watch | Potential changes to US tariff policy are contributing to the recent rise in economic policy uncertainty. On April 2, President Trump is expected to announce additional tariffs, including sector-specific and reciprocal tariffs. While Trump has indicated flexibility and a willingness to negotiate up until that date, many unknowns remain. As our economist has noted, tariffs do not necessarily stifle an economy, but prolonged uncertainty can. Any clarity on tariffs could serve as an inflection point, allowing businesses and consumers to understand the new rules and begin to adapt. This clarity may also reverse the negative trend in confidence and revive some of the postponed spending, aligning with our expectation and outlook that growth will accelerate for the remainder of the year. However, prolonged uncertainty, further declines in sentiment, or a firming ‘spending freeze’ will increase the probability of a sustained slowdown.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.