Individual bonds - providing a dual benefit

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

Many investors purchase fixed income in all interest rate environments as it serves as a primary instrument in preserving wealth. Although bonds may not always be able to significantly contribute to growing an investor’s wealth, their lower risk profile can bring comfort in positioning an investor to maintain that wealth.

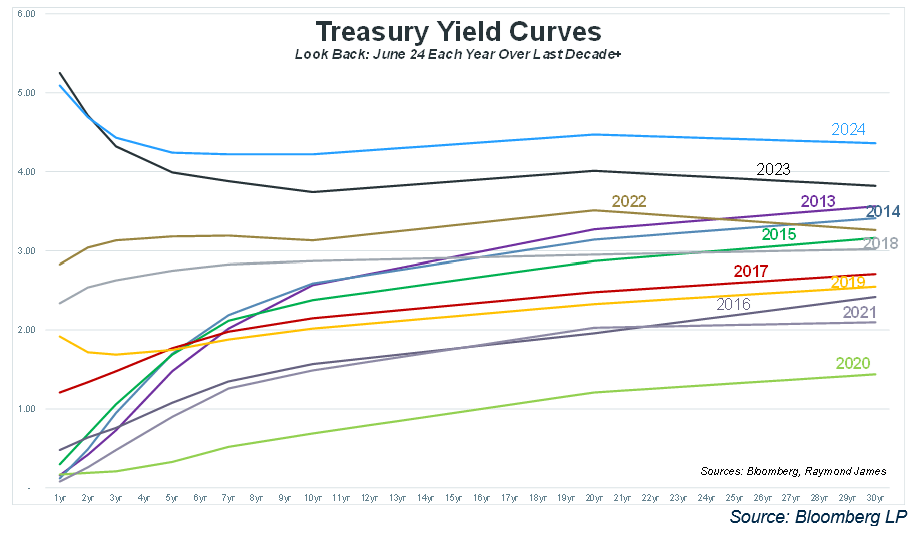

Today’s higher interest rate environment may provide an income bonus beyond the wealth preservation benefit for investors holding individual bonds. Current interest rates allow investors to capture income that has been unobtainable for most of the last 17 years. The light blue line represents today’s yield curve. The other colored lines depict the yield curve on June 24 of the corresponding year. This year’s curve boasts the highest rates and in most comparisons, at levels that exceed other years by over 200 basis points.

We have reiterated that it is a good time to shore up the portfolio’s fixed income allocation with individual bonds. Products comprising fixed income perform differently than individual bonds with the most important feature disparity being the presence or absence of a stated maturity. A stated maturity allows an investor the option of holding a bond to maturity and thus the control to cancel out the effects of price changes during the holding period. Individual bonds have a stated maturity. When an individual bond is held to maturity, interim price changes become irrelevant since they are never realized. The cash flow and income stream earned never change for the investor (baring an outright default). Default is not likely when investing in high-quality, investment-grade credits. Moody’s analysis, spanning a 51-year range of data, shows that the one-year default rate for Baa-rated corporate bonds is 0.15% and 0.03% for municipal bonds. You may look at that and say 99.85% of corporate bonds and 99.97% of municipal bonds did not default.

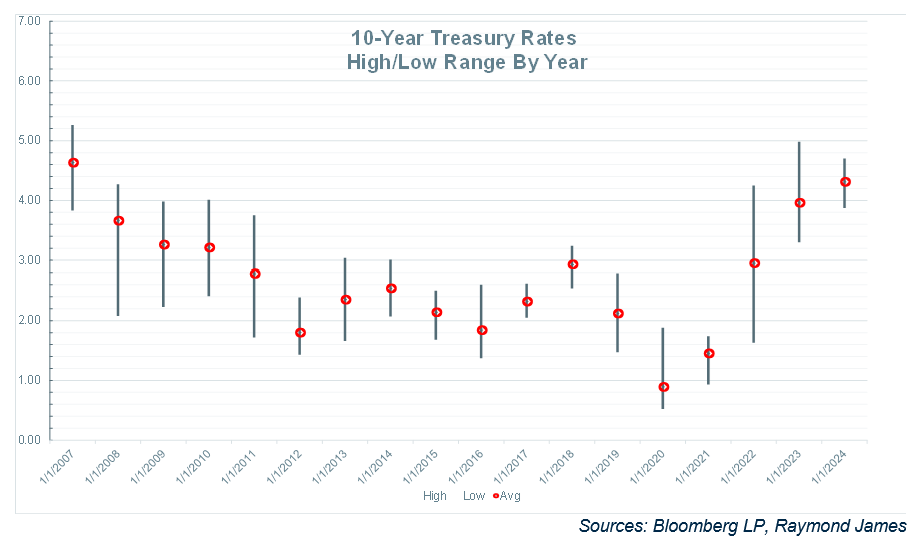

This graph isolates the 10-year Treasury. The longer the vertical line, the more widespread the yield was in any given year. The red circle depicts the average yield for each year. This year (2024) shows that the 10-year Treasury rate has stayed in a pretty tight yield range and that the average yield has been higher versus every year since 2007. Interest rate cycles are typically long which may suggest that once interest rates begin to fall, it may take a long time before they come back up. This long term sense of timing may be of particular consideration for investors at or nearing retirement. Capitalize on higher yield levels with individual bonds while the current rate environment persists.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.