New Highs

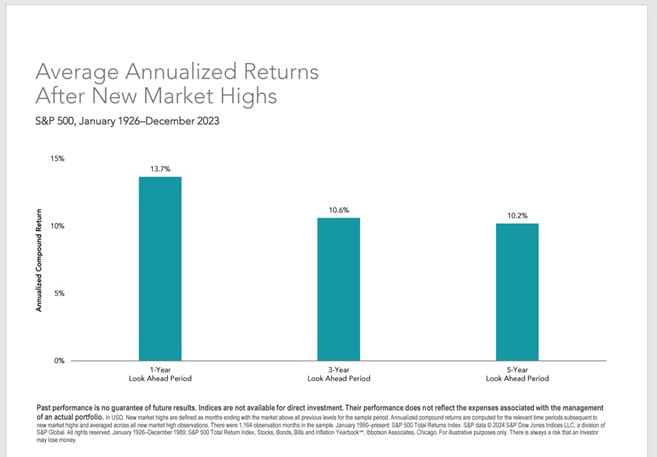

Given the fact that the market has made several new highs this year, investors sometimes question whether it is a good time to add funds to their portfolios.

Since a picture/chart is worth a thousand words, we thought the chart below may be helpful in answering that question. This chart shows, going back to 1926, what returns have averaged after the market makes new highs.

Chart source: Dimensional Fund Advisors

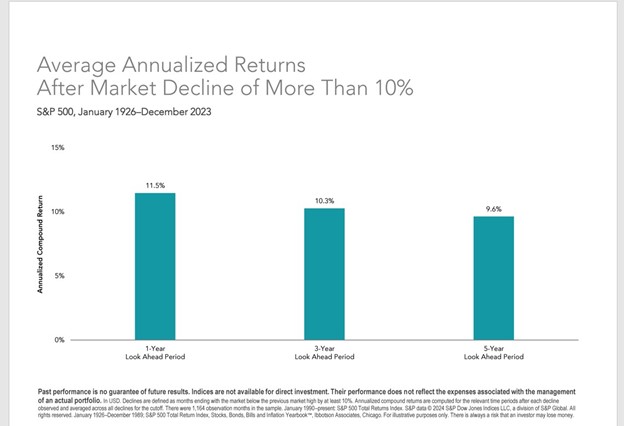

And regarding what have been the benefits of waiting until the market declines at least 10% from current levels, the chart below answers that question.

Chart source: Dimensional Fund Advisors

Historically, there hasn’t been any significant difference for investors’ returns based on these two scenarios, with just a little better performance after new highs. But since we have had this come up in some client conversations, we thought you might find this helpful.

As always, we will try to keep you updated with what seems to be on top of our clients’ minds. Please don’t hesitate to get in touch with us on any question you may have.

Thank you again for your trust and confidence in us.

Beach

Disclosure: Any opinions are those of Beach Foster and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained here does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. There are special risks associated with investing with bonds such as interest rate risk, market risk, call risk, prepayment risk, credit risk, reinvestment risk, and unique tax consequences. To learn more about these risks and the suitability of these bonds for you, please contact our office. If you no longer wish to receive this letter, please reply “unsubscribe”.