Personal consumption expenditure – An inflation measure

- 06.10.24

- Markets & Investing

- Commentary

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

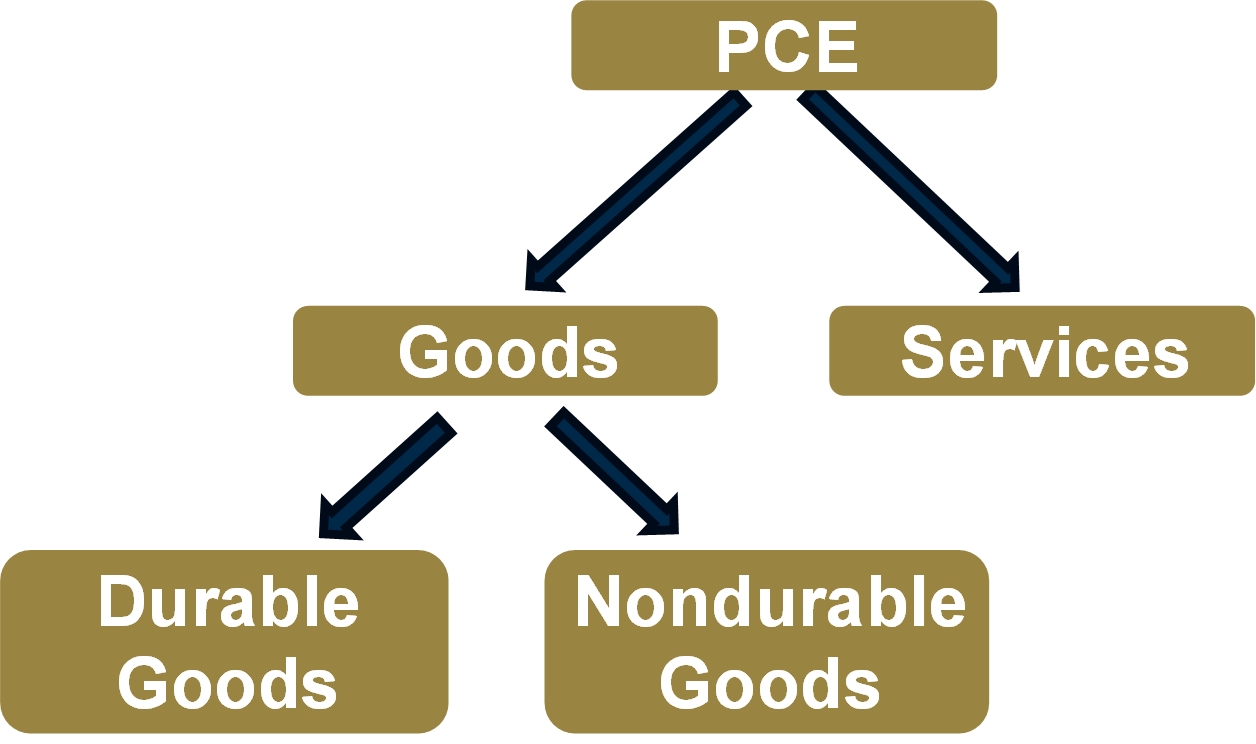

Personal Consumption Expenditure (PCE) measures the price paid for goods and services by consumers. It reflects changes in consumer behavior and captures inflation (or deflation) across a wide range of consumer expenses. Prices for both goods and services are measured. Durable goods are items or possessions that last longer than three years, such as furniture, cars, appliances, etc. Nondurable goods include everything else. Services include labor or actions across all sectors of the economy.

Sometimes PCE is expressed in terms of core PCE which excludes food and energy from the mix. Their exclusion is meant to make the underlying inflation trend clearer by excluding the two relatively more volatile items. PCE is computed by the Bureau of Economic Analysis (BEA), a government agency. According to the BEA, PCE is a significant driver of the U.S. gross domestic product (GDP). PCE can be an indicator of economic strength. It reflects price changes which may affect consumer spending.

The Federal Reserve (Fed) has an inflation target of 2.0%. Their preferred measure of inflation is PCE which has averaged approximately 2% over the last 30 years (1.99%). PCE spiked during the COVID pandemic to a high of 5.57% and although it has tailed off considerably since then, it remains historically elevated at 2.75%. The market has focused on inflation, thinking that the Fed’s policy would change as soon as it is under control and close to its 2% goal. Although inflation is running high, consumer spending has been steady and the economy has been resilient; therefore, the Fed has not needed to reverse its monetary policy.

The Fed has favored PCE to the Consumer Price Index (CPI), another inflationary measure. PCE updates its category weightings monthly versus CPI’s semi-annual revisions. Therefore, PCE tends to capture consumer shifts to cheaper product substitutes regularly and CPI may get sticky on a higher estimation. PCE encapsulates both urban and rural behaviors as opposed to just urban. PCE includes 3rd-party healthcare purchases and weights healthcare heavier versus CPI. Overall, PCE covers a more comprehensive range of spending. The Fed believes it can better track nuanced changes in inflation which can indicate a growing or shrinking economy.

The Fed has a dual mandate with its monetary policy: they must uphold maximum employment and maintain stable pricing. Employment has remained strong and therefore their focus is on inflation and whether it is impairing consumer spending and thus weakening the economy.

Although inflation rose as a consequence of pandemic conditions, consumers were able to absorb its effects for a variety of reasons. Savings were temporarily boosted when businesses shut down and consumers withdrew to quiet at-home living. The government created monetary backstops and outright distributed money into the hands of consumers while administering deferrals on loans and rent. During the following years, employment restored to strong levels while wages were raised. However, many of these conditions have transformed. Savings have been depleted, government backstops and handouts have ended and employment is showing signs of tapering. Although inflation has fallen, it remains 38% higher than long-term averages. In addition, remember that falling inflation does not mean falling prices, it merely indicates that prices are rising at a slower pace. It also does not erase the effects of the inflationary period. In other words, consumers are still faced with a loaf of bread that is twice the cost as it was just 18 months ago. Consumers must also attempt to continue to absorb higher prices while personal debt has climbed to unprecedented levels. It may be likely that interest rates will remain elevated until the Fed feels obligated to react to a slowing economy at which time it is likely the market will shift and interest rates will begin to decline. Until that time, the window to capture and lock into higher income through individual bonds is worthy of investor focus.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.