Going beyond political headlines is critical

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

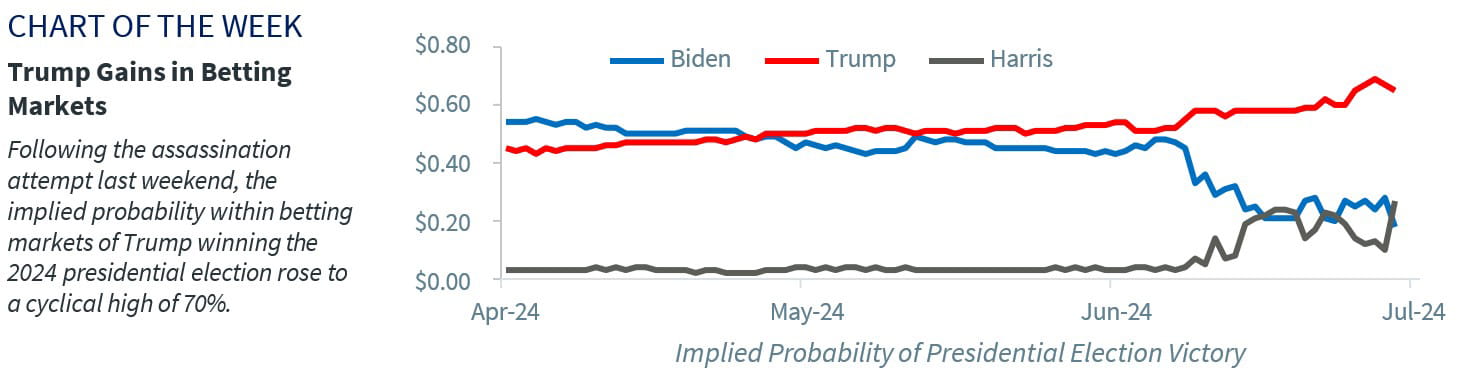

- Trump probability of victory rose to cyclical high

- Going beyond political headlines is critical

- Macro drivers oftentimes have greater impact than politics

The major political events leading up to this November’s presidential election have been nothing short of extraordinary. From Biden’s debate performance, which has fractured support for his reelection bid and raised questions about his mental acuity, to Trump’s guilty verdict and rise in the polls following last weekend’s assassination attempt, this election is shaping up like none other. Given the unpredictability of this election cycle, anything can happen in the next 109 days. However, with momentum leaning in Trump’s favor at this juncture, we explore what could happen if Trump secures a second term. We list below the key questions that we have received from investors over the last few weeks, along with our views:

- Will the Fed cut rates ahead of the election? | Former President Trump has said an interest rate cut should not occur before the election as it would favor President Biden by stimulating the economy. Yet, the market has fully priced in a September cut.

Our view: The Fed is independent and not politically motivated. This means they will do what is in the best interest of the economy without any reservations. In fact, history has shown that the Fed has cut/raised interest rates in ~85% of election years dating back to 1972. Given the softness in the economy (slowing retail spending, softening job growth, weak ISM indicators) and decelerating inflation pressures, we believe the Fed will cut interest rates twice this year, starting in September. - What equity sectors will be most impacted? | The general consensus in the equity market is that there are three sectors that will most benefit from the deregulation agenda of Trump – Energy, Financials, and Health Care.

Our view: Politics is one of the ten factors in the framework that we use to determine our equity outlook. But, it actually ranks eighth out of the ten factors in order of importance. While deregulation may be a net positive for these three sectors, it does not necessarily change our view. Factors such as the economy, earnings growth, and Fed policy need to be taken into account and are often more important in determining how a sector will perform. The point: what appears to be an obvious beneficiary in the short term may not work longer term as other factors tend to overshadow politics as drivers of asset prices. - Will interest rates climb under a Trump Presidency? | With a record national debt, concerns are growing that higher fiscal spending (via tax cuts) will put pressure on the deficit, leading to more Treasury supply at a time when demand is fickle.

Our View: The supply/demand dynamics of the bond market are important in determining the direction of interest rates. However, to date, the market has been able to absorb the additional issuance. Until we see signs of demand waning, the primary driver of interest rates should remain economic growth and inflation—both of which are decelerating. As a result, we still expect interest rates, particularly the 10-year Treasury yield, to grind lower to 3.75% over the next 12 months. - What impact will higher tariffs have on the economy and the markets? | Trump has floated the idea of 60% tariffs on China imports and 10% tariffs on imports from the rest of the world – leading to concerns that tariffs will be inflationary.

Our view: This is perhaps the biggest wildcard for the markets and the economy. We believe that these are trial balloons and a starting point for negotiations, and actions post-election if Trump can secure a second term will need to be watched closely. It is important to note that while tariffs could initially lead to higher prices (particularly if they are passed on to consumers), they can also cause a negative shock to global growth. If this occurs, it could offset the short-term inflationary impact. But in the interim, any comments that ramp up trade tensions could increase volatility, particularly given elevated valuations. - Can Trump pass even more aggressive tax cuts? | Not only has Trump called for the extension of the 2017 tax cuts (set to expire year-end 2025), but he has also called for an even more aggressive cut of the corporate tax rate to 15%.

Our view: While we do expect the extension of the Trump tax cuts in the event of a Trump victory, we view a further slashing of the corporate tax rate to 15% as unlikely. In an environment of burgeoning national debt and surging interest payments on that debt (which is nearing ~20% of tax revenues), the appetite for additional spending on top of the extension is likely to be slim. - Is a weaker dollar in the cards? | Trump’s appointment of JD Vance as his VP has led to the question of whether he will push a weaker dollar agenda in his second term, as Vance has called for a weaker dollar to help boost US exports.

Our view: Trump’s top economic goals are to boost economic growth and bring investment back to the U.S. We view a weaker USD as inconsistent with those plans. As the long-term drivers of the USD are growth and interest rate differentials, a stronger US economy will likely boost growth and interest rates, which in turn should support the dollar going forward. A weaker economy, resurgent inflation, and burgeoning deficits beyond the current trajectory would weaken the dollar.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.