The calm within the storm

- 03.24.25

- Markets & Investing

- Commentary

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

There are thousands of television news programs telecast from around 383 TV news channels, 44,000 radio stations providing news coverage, and over 100,000 newspapers globally, all creating noise for investors to digest. The DOW and S&P 500 Index have fluctuated over 17% from their highs to lows over the last year. Since May 2020, inflation (CPI) has gone from a low of 0.1% to a high of 9.1% and back to 2.8%. It is no wonder why any investor might at least pause in this period of uncertainty. Wouldn’t it be nice to be able to ignore the noise and have a better feeling of certainty? Individual bonds can mitigate or eliminate much of the uncertainty created by the noise and provide greater assurance for investors wanting or needing a source of capital preservation.

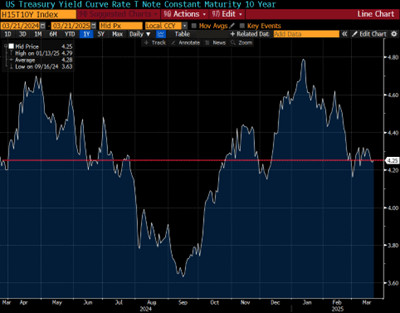

The most important fixed income benefit for many investors is that it is a product designed to preserve wealth. This holds true whether the economy is in a 1% or a 10% rate environment. Since the interest rate environment has been elevated for nearly two years, a reminder about fixed income’s role in the portfolio may help channel perception about rates. Getting caught up in media noise and confusion can unnecessarily bias long-term focus. Let’s look at the ten-year Treasury as an example. The graph looks back one year on 10-year yields. Despite the interim volatility, the 10-year Treasury closed Friday at 4.25%, just two basis points different than the 4.27% rate recorded one year earlier.

Now let’s expand that look and put it in perspective. As investors, we sometimes feel like we missed an opportunity if we purchase a bond at 5.1%, and a week later, we could have purchased it at 5.2%. Trying to time the market can be frustrating but may be less of a concern with the fixed income allocation. In this example, the market may have moved the other way, and the same bond yielded only 5% a week later. The two important takeaways are that fixed income’s primary purpose is often to preserve wealth. When purchased and held to maturity, the income, cash flow stream, and the date of the return of face value do not change regardless of environmental changes, market noise, or any other interim event. In other words, individual bonds provide a known result, rendering their benefits different from other investments in preserving wealth. The second takeaway is that the market is providing a secondary fixed income benefit with higher rates. Look at the next graph and realize that regardless of when a bond was purchased over the last year, it was good timing in perspective to the last 17 years.

For approximately the last two years, investors have benefitted from a yield entry point that is higher than was obtainable versus the 15 years prior. Investors will always need fixed income to better balance the risks associated with growth assets, which is especially true as we approach or enter retirement years. What is appealing today is that investors can also accumulate meaningful income returns provided by this elevated rate environment.

Do not get caught up in the noise, confusion, and uncertainty that can be paralyzing. Fixed income is about long-term planning and long-term benefits. Now is a great time to reap two benefits with your portfolio’s fixed income allocation.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.