Strategic Retirement Saving: Diversifying Your Buckets for a Tax-Smart Future

I like to start every retirement planning conversation with the same two questions:

Do you trust the IRS to always act in your best interest?

and

Do you think it is likely that tax rates will be lower in the future than they are now?

I bet I could guess your answer to both….yet for some reason, most people save all of their retirement savings in their 401K or Traditional IRA which gives the IRS full control over their tax brackets in retirement!

I like to believe this is because most people don’t realize there is a better way.

Planning for retirement is like assembling a jigsaw puzzle – every piece plays a crucial role in creating the full picture. When it comes to saving for your golden years, it's not just about stashing cash under the mattress or crossing your fingers. Many people will spend as many years in retirement as they spent working. Meaning your retirement savings may need to last 30 years or more!

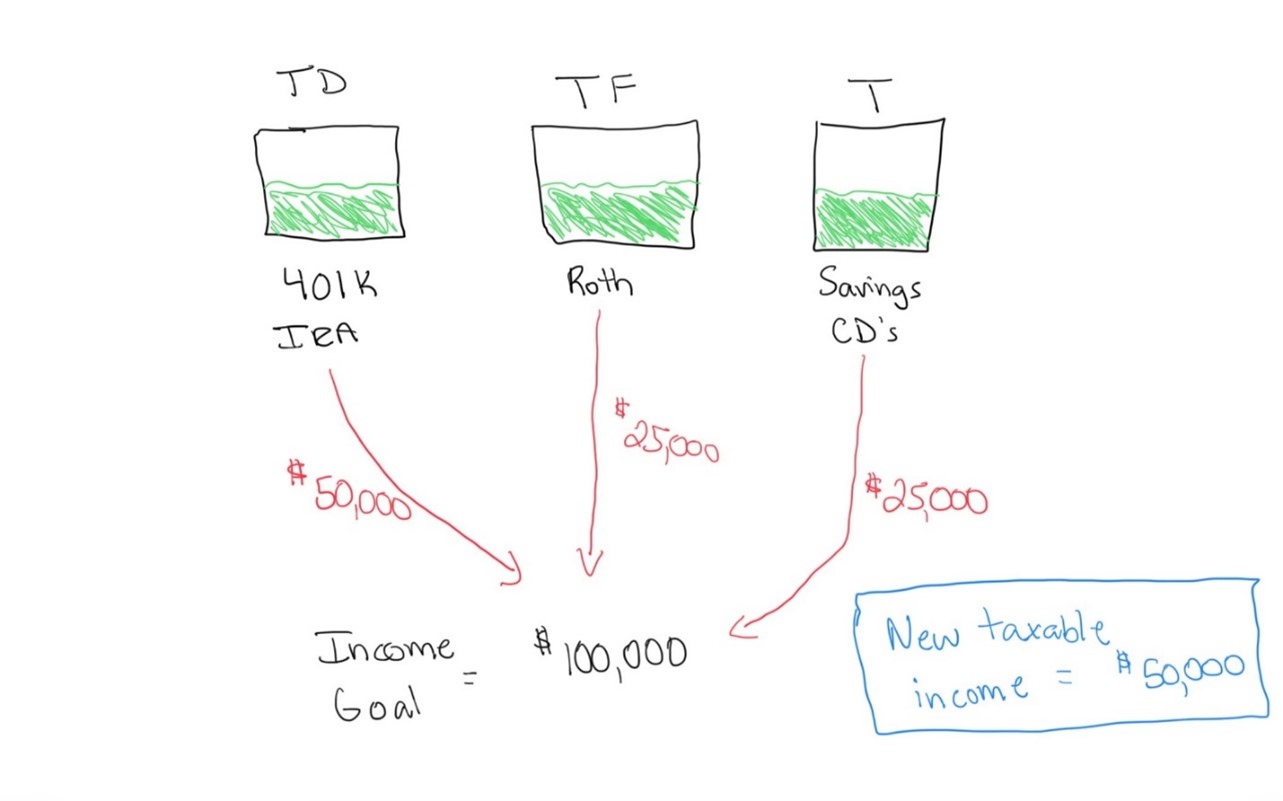

Let's explore the three buckets to save for retirement and why having a mix of them is your ticket to tax-smart retirement bliss.

Tax-Deferred Bucket: The 401K and Traditional IRA

Imagine this bucket as the financial version of a time capsule. Your contributions to a 401K or Traditional IRA grow tax-deferred, meaning you only pay taxes when you withdraw the funds during retirement. You get a tax benefit by making contributions today, but you owe tax on 100% of the amount you withdraw in the future. This is the bucket that most individuals focus on funding. The idea is that you fund the account today and get a tax deduction while you are working and likely in a higher tax bracket and then you will be in a lower tax bracket when you retire and begin withdrawing the money. But, what if the IRS raises tax rates before you retire? Do you really want all your retirement savings in one vehicle that gives the IRS full control of your tax bracket in the future? Your 401K/IRA is a CRUCIAL part of your overall retirement savings strategy. However, it is not the only option.

Tax-Free Savings: The Roth 401K and IRA

In this bucket, contributions to a Roth IRA or Roth 401K are made with after-tax dollars, but the beauty lies in the tax-free growth and tax-free withdrawals during retirement. With this bucket, typically, the longer the money has to grow, the larger the benefit in the future. It’s like having your cake and eating it too – tax-free!

Taxable Savings: Savings accounts, CD’s, and Traditional Brokerage Accounts

Consider this bucket as the financial Swiss Army knife. Savings accounts, Certificates of Deposit (CDs), and traditional brokerage accounts offer flexibility and accessibility, but they come with taxable consequences. While you won't dodge taxes here, having money in this bucket gives you flexibility in managing your tax liability during retirement. It's the 'pay-as-you-go' strategy for your financial journey. Money goes in after tax with not many future tax benefits. You pay tax on the interest, dividends, and capital gains as they are earned; though dividends and capital gains may be taxed at more favorable tax rates than interest income. However, there aren’t any penalties on early withdrawals from this account like there may be in previously mentioned retirement accounts.

Now, why the three-bucket approach? Picture this: in retirement, if all your funds are sitting in the tax-deferred bucket, you're like the sole contestant in a "pay the taxman" game show. Every dollar you withdraw is subject to taxation, potentially pushing you into higher tax brackets.

Enter the tax-free and taxable buckets – your strategic allies.

Having a mix allows you to craft a tax-efficient withdrawal strategy. By strategically pulling from the tax-free and taxable buckets, you can control the amount withdrawn from the tax-deferred bucket. This dance of financial juggling might just put you in a lower tax bracket, ultimately saving you more money in the long run. The name of the game is to withdraw the income needed in retirement and pay the least amount of tax as legally possible. If all your money is in the tax-deferred bucket, you’re out of options. By utilizing these other buckets, you give yourself more options and flexibility.

In the grand financial puzzle of life, it's easy to lose track of the pieces. That's where I come in. As a financial advisor, I'm here to guide you through the retirement savings maze, ensuring each bucket gets its fair share of attention. Let's craft a retirement strategy that's not only financially sound but also tailored to your unique journey. Reach out, and let's make sure you're saving for tomorrow and not paying the tax-man any more than his fair-share. Your tax-smart retirement awaits!

*Any opinions are those of Tyler Morris and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.