OUT OF THE WOODS

Market Update 8/18:

The first half of 2022 was not kind, in fact, it was the worst start in 50 years for the stock market. Given all that is going on, resurging inflation, rising interest rates, quantitative tightening, a war, stock, bond & currency volatility and an inverted yield curve, seems there is no shortage of things to fret about. Below is a list of recent market commentaries from managers, strategists and analysts that I respect, including Greg Jensen from Bridgewater, Jeremy Grantham from GMO, Ed Chancellor, Antti Ilamanen, Jim Chanos, Jim Grant, and David Einhorn, see links below if interested.

Many seem to think although prices are down, valuations are still rich in the US. That likely means future returns will be meaningfully below historical averages in the US. On top of that, the economy is slowing and the Fed is pretty aggressively raising rates. In Europe, there is an acute energy shortage with probable significant economic consequences.

As long as the Fed is raising rates and inflation exceeds markets expectations, seems we are likely to see heightened volatility. Most believe inflation will be higher than the markets anticipate as break-evens suggest the markets think inflation will fairly quickly return back to 2.5%. This would make a strong case for TIP’s and diversification broadly, including value stocks, gold, Japan, emerging markets and natural resources.

Profit margins are still substantially elevated vs. the past as well, maybe on order of 50%+ above average. If or when we do see a slowdown, a recession hits, high profit margins are likely to retreat, reducing earnings…and likely the stock market. This first leg down in the stock market was likely interest rate driven…i.e. the 10 yr. TSY went from 1.5% to 3%.

Margin pressures are coming from many sources including wages, and labor as a share of income is historically low. There appears to be a globalization unwind, as companies favor security and stability vs. price in their supply chains. The cost of goods, commodities, oil, metals, etc. are also pressuring profitability. Lastly, going down the income statement, interest expense is increasing as rates rise. Broadly, earnings estimates do not appear to have come down sufficiently to reflect a recession.

Perhaps we’ve seen the peak in inflation, perhaps the Fed is near done. Futures markets are now pricing in a rate cut next summer. We may already be in a technical recession now, 2 negative GDP quarters. Maybe a cease fire comes soon, there are some positive narratives, as the markets now reflect at least to some degree current events - that is; inflation, the Fed, potential slowdown, War etc. All that said, suspect we’re not out of the woods quite yet...

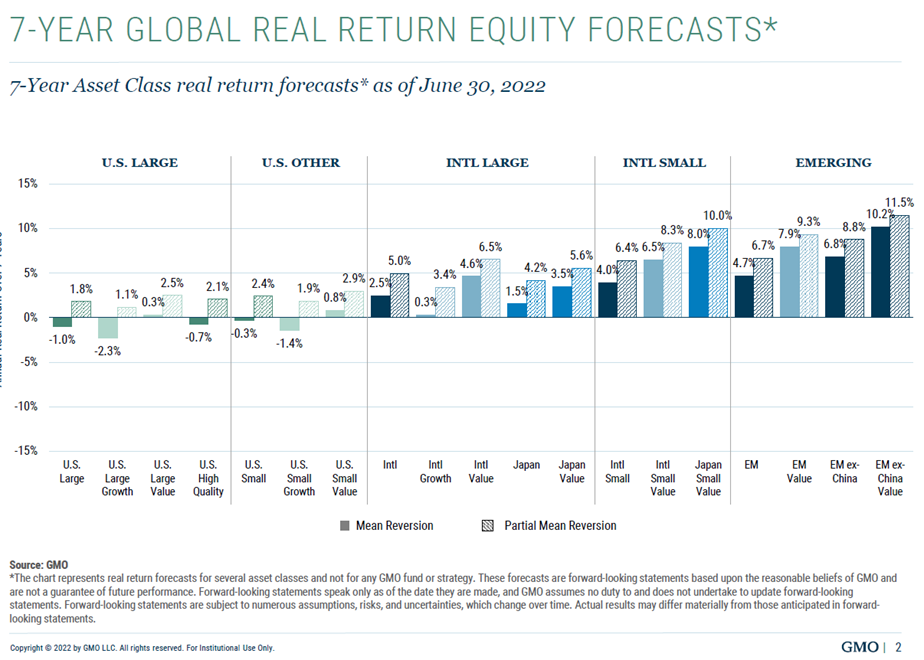

Let’s end with some good news! GMO forecast thru 6/30 came out and the selloff has really improved medium term anticipated returns. Growth stocks went from -7% real to close to 0% real. Even better, already moderately cheap asset classes, like Japan value stocks, EM value, resource stocks got even more attractive, now priced for 8% to 11% + after inflation or 10% to 14% nominal.

Noteworthy recent research and market commentary:

- Cliff Asness: https://www.aqr.com/Insights/Perspectives/Value-Spreads-Back-to-Tech-Bubble-Highs-Are-You-People-Crazy, Value still looks very attractive vs. growth

- Bridgewater, Bob Prince: https://www.bridgewater.com/research-and-insights/an-update-from-our-cios-transitioning-to-stagflation

- AQR: Capital Market Assumptions: https://www.aqr.com/Insights/Research/Alternative-Thinking/2022-Capital-Market-Assumptions-for-Major-Asset-Classes

- Greg Jensen, Fed, tradeoffs, inflation vs. asset prices, inflation underpriced, https://ttmygh.podbean.com/e/teg_0034_greg_jensen-preview/

- James Grant, Edward Chancellor, history of markets, interest rates, USD, inflation, asset valuations, Japan, Emerging markets, https://podcasts.apple.com/us/podcast/the-nature-and-essence-of-interest/id1207583745?i=1000568318913

- Meb Faber & Edward Chancellor, https://mebfaber.com/2022/08/17/e437-edward-chancellor/

- David Einhorn, US debt & deficits, Gold, https://www.youtube.com/watch?v=YvbjYTebx88

- Robert Horrocks, Matthews, Asia, valuations in EM, China, risks, geopolitical, regulation, covid, stability, https://wealthtrack.com/horrocks-beyond-asia/

- First Eagle update, foreign stock valuations. …many cases trade in-line with past slowdowns, recessions, https://www.firsteagle.com/july-views-first-eagle-global-value-team

- Ruane, buying SAP, adding to Netflix, https://www.sequoiafund.com/Communications

- Jeremy Grantham, https://www.theinvestorspodcast.com/episodes/the-bear-has-arrived-w-jeremy-grantham/

- Antti Ilmanen: AQR, low returns, https://podcasts.apple.com/us/podcast/investing-in-a-world-of-low-expected-returns/id1490296778?i=1000569685007

- Hussmann Funds: Structural Drivers of Investment Returns: https://www.hussmanfunds.com/comment/mc220815/ might skip if you’re looking for something cheery

Ben Clauss, CFA

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Ben Clauss and not necessarily those of Raymond James.

Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Past performance may not be indicative of future results.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.

Diversification and asset allocation do not ensure a profit or protect against a loss.