Global Portfolio Diversification Part 1: Home Country Bias

Written By: Jim Gillis IV

My opinion has always held that if you are invested in a truly diversified portfolio, there will always be positions within the portfolio that you question the benefit of owning. For a US investor who has owned a globally diversified portfolio over the past 10 years, many might be asking “Why do I even own international assets?”

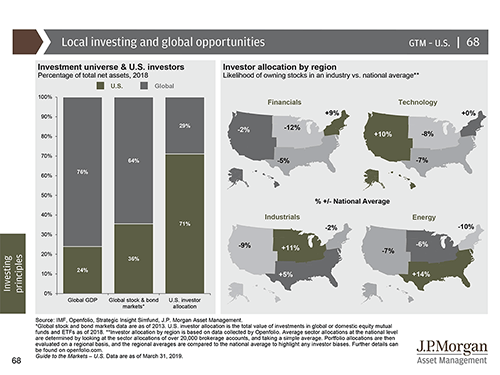

While the US still boasts the single largest economy in the world, it accounts for only 24% of global GDP and 36% of the world’s capital markets. Yet, statistics show that U.S. investors have nearly 75% of their equity and fixed income investments in U.S.-based assets.

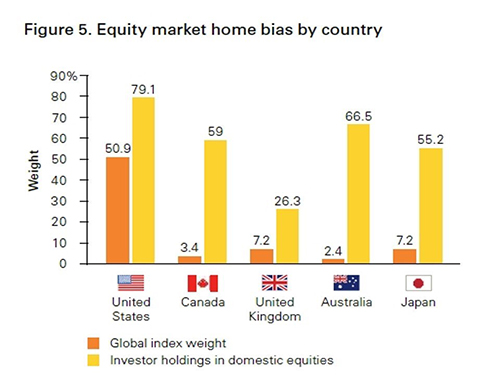

Looking at the chart below from Vanguard, it is evident that home-country bias within equity-only portfolios is pervasive among investors around the globe. This should be of no surprise since most of us tend to gravitate toward the familiar, both in general and with regard to our investments.

Being home-country biased as a US equity investor has been beneficial as can be seen when examining 3, 5 and 10-year annualized returns.

| Index | Region | 3 Yr | 5 Yr | 10 Yr |

| S&P 500 | United States | 13.51% | 10.91% | 15.92% |

| MSCI EAFE | Europe, Australasia & Far East | 7.27% | 2.33% | 8.96% |

| MSCI ACWI Ex. US | All Country ex. United States | 8.09% | 2.57% | 8.85% |

*Source: MSCI and S&P Dow Jones Indices. Data as of 03/29/2019.

Despite the meaningful outperformance of US stocks over the prior 3, 5 and 10 years, it is important to note that an overweight to US-based assets is an active allocation decision.

In the coming weeks, we will examine the issue of global diversification in more detail.

Disclaimer: Any opinions are those of Jim Gillis IV and not necessarily those of RJFS or Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.