What exactly is Exit Planning?

Most business owners may be familiar with the term “Exit Planning,” but few fully know what it entails. In fact, only an estimated 28% of private businesses have done any form of exit planning. What we commonly see is that many owners wait until the last minute -- having just experienced a “hardship” (50% of all exits are not voluntary), or they received an offer out of the blue of which they are unprepared to accept or negotiate. This is not a position a privately held business owner would choose for their inevitable exit; yet as stated above, 72% admit they have not done any exit planning.

The Fundamentals:

An exit plan is a road map that leads the business owner to successfully achieving a desired outcome from the business. It is derived from asking and answering all the business, personal, financial, legal, and tax questions involved in selling a privately owned business, all while addressing potential contingencies and strategies to increase the overall value of the business.

Simply put, Exit Planning is just a good business strategy. A common piece of advice I give to entrepreneurs is to never get into something without already knowing how to get out (or at least having a plan in mind). This may stem from my experience in the Army where we went into every mission always prepared with an exfil plan, a contingency plan, and a clear mission objective.

An owner of a privately held business should have the same mindset. Know what you want to accomplish with your business (both personally and financially), envision an exit plan and operate your business accordingly, and always have a contingency plan that is ready to protect what you have built.

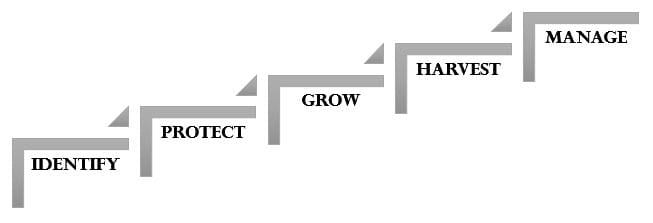

Our Process:

Our process in developing an Exit Plan for a client follows these steps:

- Identify the current value of your business

- Implement risk mitigation strategies to Protect that value

- Develop strategies to increase the value of the business

- Capitalize on what you’ve grown by selecting the appropriate exit strategy capitalize

- Holistically Manage the wealth produced by your hard work to last a legacy

Following this process allows us to create a tailored Exit Plan for our clients while encompassing what is important to you, the client.

Aim to not be another statistic, and separate yourself from the competition by preparing for your inevitable exit today. We’re here to help.

J. Tyler Thompson, CFP®, CEPA®, AAMS®, WMS®

CERTIFIED FINANCIAL PLANNER™

CERTIFIED EXIT PLANNING ADVISOR®