Certificates of Deposit in Finance

Introduction: When it comes to financial instruments, Certificates of Deposit (CDs) are often overlooked in favor of more popular investment options. However, CDs can be a valuable tool for both short-term and long-term financial planning. In this blog, we explore what CDs are, how they work, their benefits, and considerations for incorporating them into your investment strategy.

- What are CDs? CDS are fixed-term savings accounts offered by banks and credit unions. They provide a less volatile and confident way to earn interest on your savings while preserving the principal amount. CDs are known for their low-risk nature, making them an attractive option for conservative investors.

- How do CDs work? CDs have a predetermined term, typically ranging from a few months to several years. During this period, you agree to leave your funds with the financial institution, and in return, they pay you interest. The interest rate on CDs is typically higher than regular savings accounts due to the fixed term commitment.

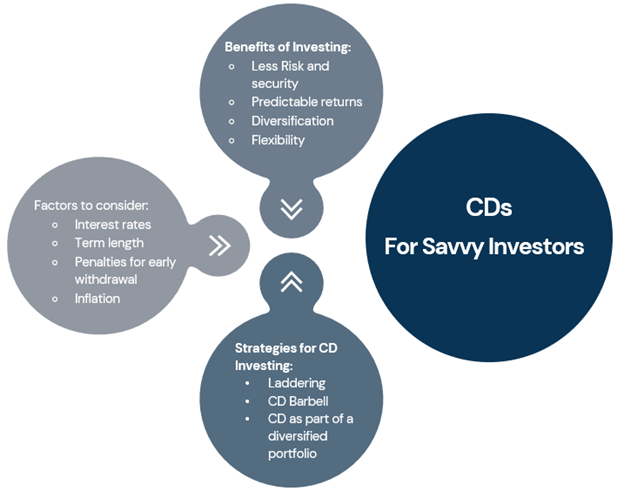

- Benefits of investing in CDs:

- Lower Risk Investment: CDs are insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA) up to certain limits, providing protection for your investment.

- Predictable returns: With a fixed interest rate and term, CDs offer predictable returns, which can be useful for short-term financial goals or steady income.

- Diversification: CDs can diversify your investment portfolio, especially if you have a higher risk tolerance in other areas.

- Flexibility: CDs come in various terms, allowing you to choose the duration that aligns with your financial goals and liquidity needs.

DIVERSIFYING YOUR PORTFOLIO:

Consider incorporating CDs into your investment portfolio to balance risk and potential returns. CDs are lower in risk and may be a predictable way to earn interest on your savings. Whether you’re saving for a short-term goal or seeking a low-risk investment option, CDs can play a valuable role in your financial planning. By understanding how CDs work, considering their benefits, and incorporating them strategically into your investment strategy, you can make informed decisions that align with your financial goals and risk tolerance. Remember to evaluate current market conditions, interest rates and your personal financial situation when considering CDs as an investment option.

It is important to always be cautious with your investments including CDs. Here are some implications to consider when considering CDs:

- Banks and credit unions can penalize savers who withdraw CD funds before maturity.

- CD rates may not be high enough to keep the pace with inflation when consumer prices rise.

- CDs can offer less liquidity than savings accounts, money market accounts or checking accounts.

Francesco Traina, CEO Brickell 21

About FDIC insurance: Currently, the FDIC limits the insured amount (including principal and interest) for all deposits held in the same capacity to $250,000 per depositor, per insured depository institution and $250,000 for certain retirement accounts. The FDIC has permanently increased insurance coverage to $250,000 for deposits held in all ownership categories, including single accounts, joint accounts and trust accounts. Therefore, excess holdings may not be insured. IRAs and certain other retirement accounts will maintain the $250,000 insurance coverage. About liquidity: Funds may not be withdrawn until the maturity date or redemption date, however, the brokered CD, are negotiable, which mean, that although not obligated to do so, Raymond James and other broker/dealers presently maintain an active secondary market at current interest rates, market value will fluctuate and, if the CD is cashed out prior to maturity, the proceeds may be more or less than the original purchase price, holding CDs until term assures the holder of par value redemption. CDs are redeemable at par upon death of beneficial holder. FDIC insurance does not protect against market losses due to selling CDs in the secondary market prior to maturity.