Individual bonds benefit from yield curve shift

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

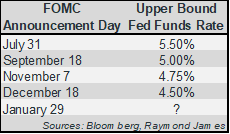

The United States central bank – the Federal Reserve – reversed its monetary policy on September 18, 2024, by beginning to cut the Fed Funds rate. The Federal Open Market Committee (FOMC) meets eight times per year to contemplate open market operations, including its decision on the Fed Funds rate. It is sometimes perceived that the Fed’s action changes all interest rates across the yield curve, but that needs to be put in perspective. The Fed cut interest rates in each of the last three FOMC meetings in 2024. The total accumulation of cuts amounted to moving the Fed Funds rate down by 100 basis points.

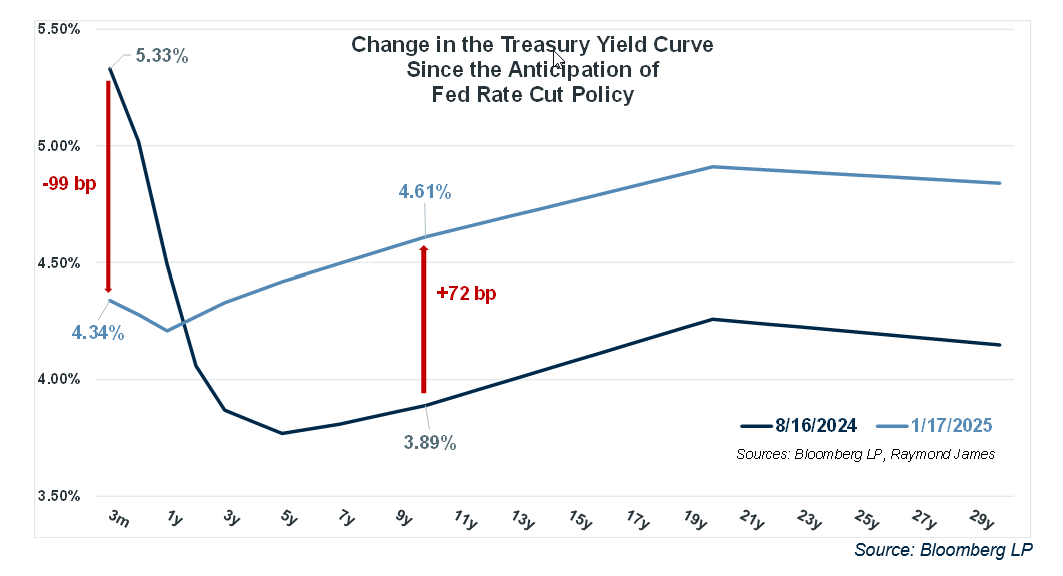

It was highly anticipated that the Fed would begin to cut interest rates. The bond market often begins to react to the news or in anticipation of where investors believe interest rates are going, sometimes well in advance of the action itself. The graph below highlights the “before” and “after” effects of the Fed’s actions. What is evident is that it has only brought short-term interest rates down. Intermediate and longer-term interest rates have risen since the Fed began cutting the Fed Funds rate in September.

The takeaways are numerous. Short money market instruments remain viable for liquidity purposes but lose luster in long-term portfolio planning. The income potential is greatly diminished. The good news is that intermediate and longer-term investment choices have picked up significantly in terms of income potential. With the yield curve turning into an upward-sloping shape, investors are once again rewarded with higher income when taking on interest rate risk associated with longer-term investments.

Individual bonds offer many attractive investment options, providing a means to lock into the wealth accumulated over the last two years of equity growth. Talk to your Raymond James financial advisor about how to take advantage of this income opportunity. In future commentaries, we will cover some of these opportunities in more detail.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.