Rates Up or Down

The Federal Reserve (Fed) reduced the short-term interest rates (the Fed Funds Rate) that they control by 50 basis points (1/2 of 1%) on September 18. That interest rate cut was well covered by all the news media outlets. Below is a chart showing the drop in the one-year Treasury bill.

Source: CNBC

But what has not been so much publicized is what has happened to “interest rates” since then. I put interest rates in quotation marks because there are a variety of interest rates in the market.

The interest rate that the Fed cut is the one that affects the shortest interest rates, such as money market funds, short term certificates of deposit etc.

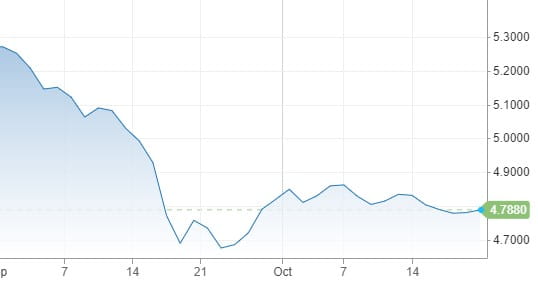

Longer term interest rates, such as the ten-year Treasury bond, is one of the most influential interest rates in the market for consumer borrowing. It is the interest rate that affects many common debts such as home mortgage rates, car loans, etc. It has moved in almost the exact opposite direction and amount of the short-term rate cut by the Fed.

On September 17, the day before the Fed announced their 50-basis point cut in short term rates, the ten-year Treasury was at 3.62%. As of October 24,the yield is 4.20%, or 58 basis points higher than it was before the “rate cut.”

The chart below shows the increase in the interest rate of the ten-year Treasury bond. It is a little dated, showing the 10-year yield at 4.17%.

Source: CNBC

So did the Fed reduce or increase rates? The answer is yes.

We thought it was important for you to understand that, surprise surprise, nothing is simple. While the Fed does control the shortest-term interest rates, market participants such as mutual funds, pensions, individuals, and insurance companies etc. are the rate-setters for longer term interest rates. And these market participants are more worried about what the “real interest” rate is for them.

The “real Interest rate” is the return after accounting for inflation. And their concern is that the Fed, by reducing short term rates, is increasing the chance of a somewhat higher inflation rate in the future, so they demand a higher return to compensate them for that risk. The expected increase in our government’s deficits are also seen to be inflationary by investors.

We don’t know where interest rates will be tomorrow, or next month or next year. Again, we are not at a disadvantage because no one else knows either (regardless of their forecast).

That is why we implement an interest rate investment strategy (bond strategy) that has some of your bond assets in short-term, medium-term bonds and longer-term bonds. Because we don’t know where interest rates will be in the future, our goal is for you to be ok in any potential interest rate scenario. If rates go up, short term bonds will be maturing soon and can be reinvested at the higher rates. If rates go down, the intermediate and longer-term bonds will provide some protection to your income and can also increase in value.

Our goal for your portfolio here is survival should things move in unpredictable ways, which the bond market has done recently. That seems like a rather modest goal, and it is. But we have seen many events occur that nobody predicted and particularly the significant consequences of those who invested as though they knew the future but were wrong.

Hopefully this helps explain some of movements in the financial markets and why we take the approach we take with the assets you have entrusted with us.

Thanks as always for your trust and confidence in us.

Any opinions are those of Beach Foster and not necessarily those of Raymond James. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and investors may incur a profit or a loss regardless of strategy selected.

Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.