It Seems Hard to Believe

It seems hard to believe, but the stock market is up this year.

With the recent news of bank failures, a slowing economy and the Federal Reserve Bank (Fed) continuing to raise rates, it doesn’t seem like the market would be up 6% in 2023, but as of March 31 that is the case. And overseas developed markets are up even more, about 8%. And that is with one of the biggest European banks also having failed and being taken over.

This is another reason we don’t (nor should anyone) make a prediction about what the market will do over the short term. Even if we have the privilege of knowing certain facts about the future which would seem important, we could easily draw the wrong conclusion regarding the market’s response to that news.

But that has what has transpired so far this year. We believe this illustrates the importance of our bedrock beliefs regarding wise investing- stay diversified, don’t ever think we can time the markets, and paying someone in hopes of them outsmarting everyone else in the market just does not work.

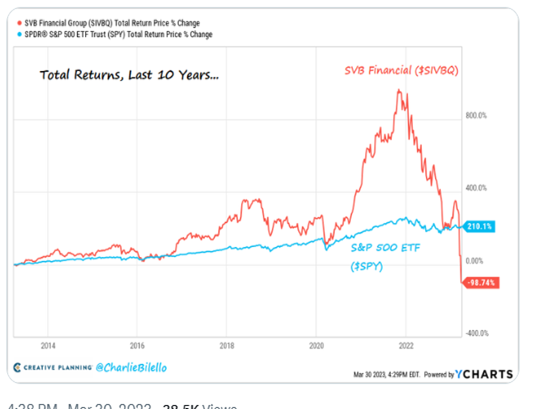

Taking diversification first, below is a chart showing the performance of Silicon Valley Bank versus the S&P 500 over the last ten years.

Silicon Valley Bank was doing much better than the market- until it wasn’t. The lure of hitting a home run with an individual stock is tempting, but often the risk that accompanies that potential reward can be dramatic.

The upside of diversification is equally important. This year, about 6 stocks have accounted for all the return of the market. And these were some of the stocks that got pummeled in 2022. So if you didn’t own these stocks, you were flat or down this year. And this is the upside of diversification.

Academic studies have shown that the return of the average stock is nothing to write home about. It is, literally, a handful of stocks that are huge performers that provide the real returns of the stock market. And the only way to know you own these stocks, is to own them all – the good, the bad and the ugly.

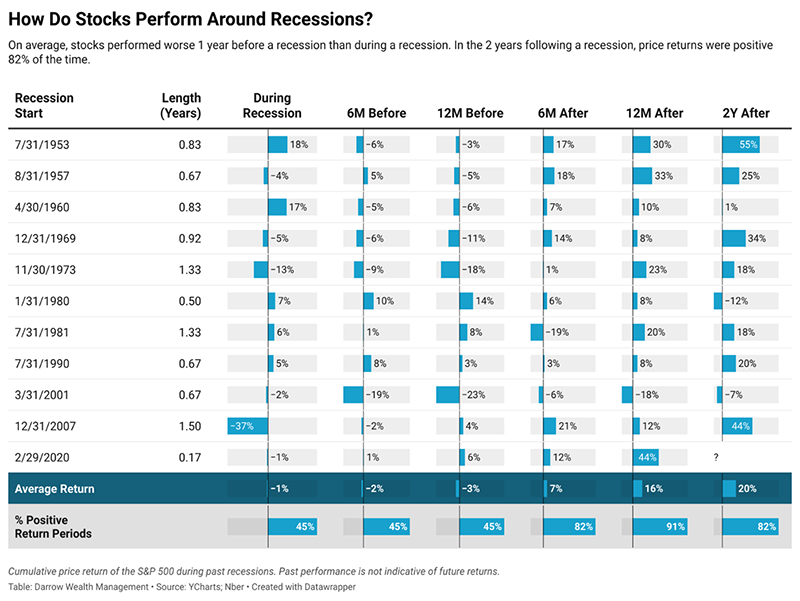

Regarding timing the market, the chart below looks at the last 11 recessions we have had since 1950, and the stock market performance before, during, and after recessions. If you look at the bottom row that shows the percentage of positive periods, you can see how often the market is positive right after it and almost 50/50 before and during a recession. So even with the benefit of knowing a recession is coming, it is almost a coin flip if the market is going to be up or down.

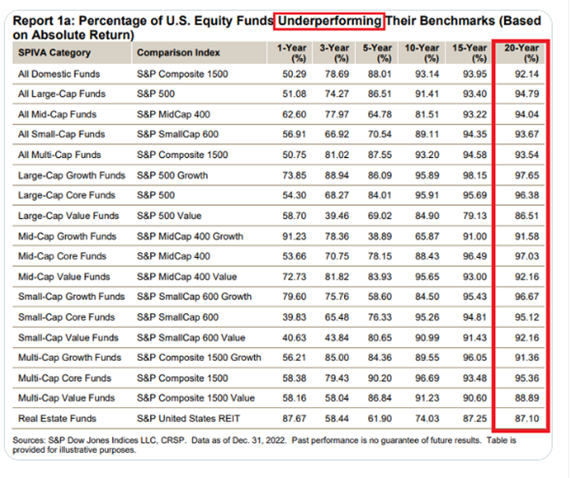

The last part of our investment philosophy that is amply supported by much evidence is eliminating the cost and risk of hoping to find someone who is smarter than all the other investors combined and paying them to “beat the market”. The ability for a few investors to beat the market may have been possible in the past when the majority of shareholders were individuals who were at work all day as doctors, lawyers, and business owners. But with the vast majority of shares now held by institutional investors on behalf of those shareholders, the competition is much tougher with information shared instantly and price adjustments moving quickly reflecting any and all new information.

Below is a chart showing what percentage of “active managers”- people who are paid to outperform the market- have beaten the market over various time periods.

So you can see we put the odds on your side by investing in the indexes rather than hoping we can find the needle in the haystack.

As always, don’t hesitate to call with any thoughts, questions or concerns and we will be in touch.

Thanks as always for your trust and confidence in us.

Beach

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information provided does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but there is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Any opinions are those of the author, and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Diversification does not ensure a profit or guarantee against a loss. Investing involve risk and you may incur a profit or loss regardless of strategy selected. Past performance may not be indicative of future results.