Different Types of Risk

Seeing the stock market drop 1,000 points in a day as it did on Monday, August 29th can be unsettling, even if it was only a 3% drop. It feels like the definition of risk.

But what is risk?

- Is it owning assets that fluctuate a lot in the short term?

- Is it money that is permanently gone, as if you owned a company that went bankrupt?

- Is it owning assets that don’t keep up with inflation?

- Is it the risk of making a bad investment decision during a particularly stressful point in the market cycle?

We can all agree that all of these qualify as risks. And we would all prefer a way to meet our long- term goals with no indigestion along the way.

Unfortunately, cash which is the least volatile asset class does not provide the return required to meet most of our goals. So we must accept some degree of volatility in our monthly statements in order to have a higher probability of meeting our goals.

Let’s discuss the above-mentioned risks one by one:

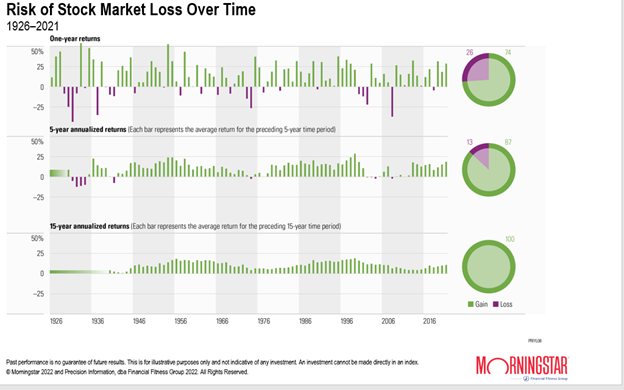

Short-term fluctuation

An asset class that is volatile in the short-term certainly describes the stock market. Attached is a chart showing how the volatility of the stock market in 1- year observations, then 5 -year periods and then 15- year periods. As you can see, year to year the stock market is volatile, but going to a 5- year horizon eliminates many of the downturns and at 15 years there has not been a negative return.

Company risk

Regarding the risk of owning a company that goes bankrupt, that risk is mitigated by owning funds that are very diversified.

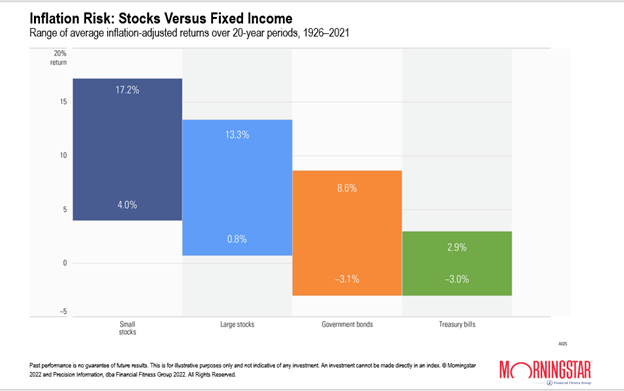

Inflation

Regarding inflation and the risk that you lose your purchasing power, there are historical observations we can use to guide our strategy. Below is a chart showing the inflation adjusted returns of 4 different assets. As you can see, the best inflation hedge from financial assets is small stocks and large stocks, followed by bonds and cash. Not on this chart, but real estate and precious metals can also be potential inflation hedges.

Investor behavior

The last risk we mentioned was how investor behavior can affect the probabilities of reaching your goals. Unfortunately, the statistics are very clear- many investors have consistently hurt themselves by buying when prices are high and selling when prices are low. This is just the opposite of our behavior when we are shopping for groceries, appliances, cars etc. And it can be very destructive to achieving your goals.

There is no shortage of risks in the investment world and there is no perfect way of eliminating all of them. But hopefully with the right perspective and understanding, we can differentiate short term risks from long term risks. Investments that may be extremely steady such as cash and CDs, can possibly present big risks to maintaining our purchasing power for many years. Stocks can present a lot of volatility short term, but since 1926 have proven to provide a reasonably good return even after adjusting for inflation.

As always, please don’t hesitate to call with any thoughts, questions, or “what ifs” about your strategy.

And thank you for your continued trust and confidence in us.

Beach

Disclosure: Any opinions are those of Beach Foster and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained here does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Prior to making an investment decision, please consult with your financial advisor about your individual situation.