Five things to keep an eye on during earnings season

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- S&P 500 to post fifth straight quarter of positive EPS growth

- Mega-cap tech to be a bright spot yet again

- 2025 EPS estimates likely to be revised lower

This weekend marks the second anniversary of the bull market. Since hitting the October 12, 2022, low, the S&P 500 has climbed 65.9%! By historical standards, there is still plenty of room for the current bull market to run as the average duration of a bull market typically exceeds five years. And the most prominent reason for further upside: sustained corporate earnings growth. With earnings growth the key driver of stock returns over the long term, our positive outlook for the economy (our economist expects a soft landing) and earnings growth (we expect ~10% 2025 S&P 500 earnings growth) suggest the bull market should remain intact. And that is why we remain laser-focused on earnings trends, micro insights from companies and the macro fundamentals. With the start of 3Q earnings season just beginning (the big banks reported today with solid results), below are five things to keep an eye on during this earnings season:

- Thoughts On A Positive Earnings Season | 3Q S&P 500 earnings are on pace to rise ~4% YoY—the 5th consecutive quarter of positive EPS growth. While this is a sharp deceleration from the ~12% YoY pace in 2Q, earnings growth is likely to improve to closer to 10% if the typical pattern of earnings ‘beats’ drive estimates higher. Over the last ten years, earnings growth has been revised higher by 4-5%, on average, during earnings season. With the bar lowered heading into 3Q (S&P 500 earnings have been revised down ~4% since 6/30), investors will be focused on the magnitude of beats as valuations (S&P 500 LTM P/E 24x) are near their highest level (ex-COVID) since 2001. From a sector perspective, only six of eleven sectors are expected to see positive EPS growth in Q3—led by Tech—which would be the lowest number since 1Q23. We would like to see more sectors notch positive earnings growth to further support the recent broadening in performance.

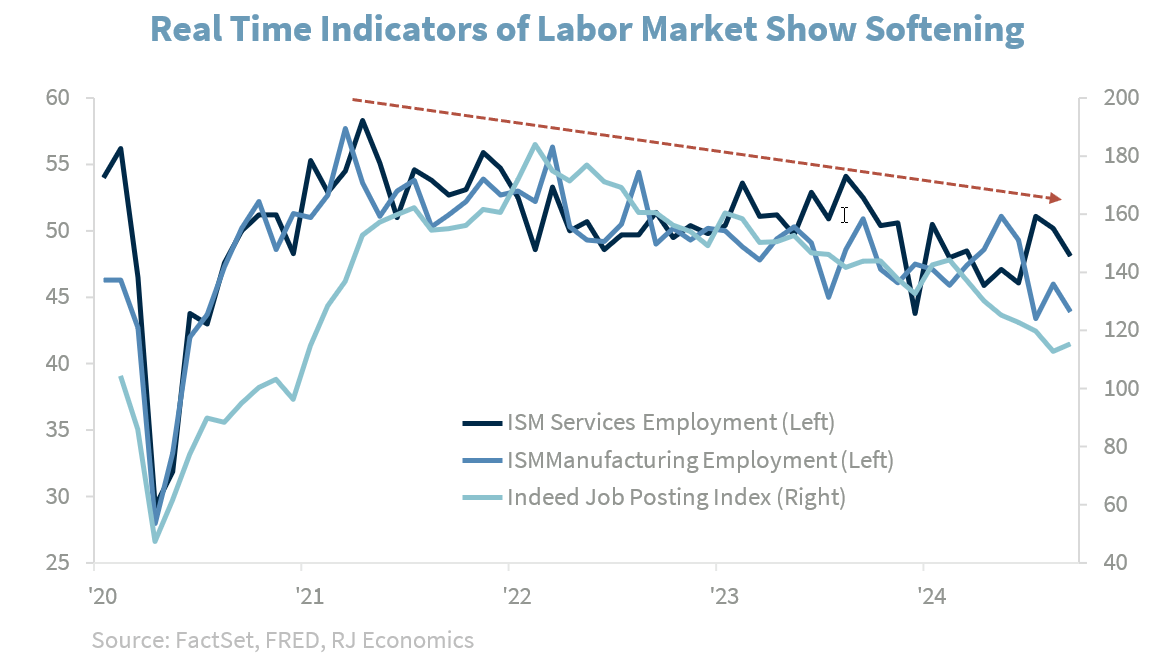

- Consumer Dynamics: Temporary Weakness Or Longer Lasting? | The resilient consumer has been a key driver of the economic expansion. This is not that surprising as the consumer makes up ~70% of economic growth. During 2Q, companies across a variety of industries highlighted that consumer spending slowed at the start of the third quarter (with August shaping up to be particularly weak). However, a glimpse into consumer demand (particularly the lower-end consumer) will be important for our economic outlook. While consumer spending is not collapsing, it should moderate further due to the slowing labor market, softening travel spending, and reduced savings. These trends should filter through to sector fundamentals, with the Consumer Discretionary sector ex AMZN likely to post negative earnings growth (-3%) for the first time since 4Q20. Weakening consumer dynamics is a key reason we remain underweight the Consumer Discretionary sector.

- Tech Trends Remain On Solid Ground | While performance broadened beyond mega-cap tech in the 3Q (tech returns underperformed the S&P 500 by the widest margin since 2Q16), Tech sector fundamentals (mega-cap tech in particular) remained solid. Case in point: while all 11 S&P 500 sectors saw downward revisions to their 3Q estimates since the start of the 3rd quarter, a composite of mega-cap tech or MAGMAN* saw its 3Q estimates revised 2% higher. MAGMAN’s earnings growth (3Q24: +19% YoY) is expected to outpace the rest of the market for the 7th consecutive quarter and every quarter through 2025. CEOs across a variety of different industries should provide a status update on both the AI build out and how industries outside of tech are utilizing AI within their business. Continued investment in AI, solid earnings growth, robust margins, and shareholder-friendly activities (e.g., increasing dividends and buybacks) keep us overweight the Tech sector.

- Small Cap EPS Growth To Turn Positive? | Small-cap equities are on pace to lag large caps on a total return basis for the 4th straight year (YTD: +10% vs. +23%). While positive economic growth, attractive valuations, and the Fed’s easing cycle should lend support to small caps, there is another tailwind on the horizon—positive earnings growth. For the first time since 3Q22, small-cap equities are expected to post positive EPS growth (+1% YoY)—ending the longest streak of quarterly earnings declines (7 quarters) in at least 20 years. To put that into perspective, the current negative earnings streak surpasses both the Great Financial Crisis (2007) and COVID-related declines. Forward guidance will be critical. While full-year earnings have been revised down 10% YTD, small cap’s EPS growth (4Q24 EPS: +16% YoY) is on track to outpace large cap’s in 4Q for the first time in two years. Accelerating earnings growth is a key reason we remain optimistic on small caps.

- 2025 Earnings in Focus | S&P 500 2025 EPS estimates have been remarkably resilient YTD. Up until now, that is. Since the start of the year, the 2025 consensus EPS estimates have been revised up 0.5% vs the average decline of ~3%. However, 3Q is traditionally the quarter analysts/management teams focus their guidance on the following year, which is why downward revisions to next year’s EPS estimates should move lower through year end. With economic growth expected to slow in 2025 (from +2.6% to +2.0%), consensus estimates for 2025 EPS (~$275) are likely too lofty relative to our estimate of $265 and should be revised lower over the coming weeks. Downward earnings estimates, combined with continued uncertainty surrounding the election and geopolitics could lead to an uptick in near-term volatility.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.