A Gift – The year was 1964. In the earliest hours of a cold, dark, and snowy Christmas day, I was awakened by the wind rattling my bedroom windows. Playground rumors had it that there was no Santa Claus. After all, how could Santa visit so many homes—and all in one night? Determined to find out, I tip-toed down the staircase to see for myself. As my eyes adjusted to the darkness, I was surprised to find nothing more than the same stuff that had been under the tree for the previous two weeks. And it was well past midnight. Seeking evidence, I hid beneath a corner table and waited. And waited. Time passed … my eyes closed … for just a moment … and when they opened, I was surprised to see many of the items on my Christmas list sitting around the tree. It happened without a sound, and all in the blink of an eye. My belief in Santa Claus was confirmed, and I snuck back to bed with a big smile.

But as the days passed, my doubts returned. Finally, under intense cross-examination Mom wearily confessed that Santa was more a ‘spirit of Christmas’ than a real person. Reality had struck, and I cried my eyes out with disappointment. Over time, however, I came to realize how easy it is for us to fool ourselves, that the truth is always there, and that curiosity helps us find it sooner rather than later. That revelation from 1964? Probably the best Christmas gift I ever received.

“If you can get really good at destroying your own wrong ideas, that is a great gift.” – Charlie Munger

Santa Pause? – Beliefs drive markets in the short-term—but reality determines results in the long-term. Last month, a turn in headline inflation triggered a Santa Claus rally in the stock market. My desktop monitors turned Christmas green that day, with the DJIA closing up 1200 points. Many investors believe that the Federal Reserve might soon pause its interest rate hikes. But just as fiscal and monetary stimulus inflated asset values during the COVID pandemic, this year’s battle against inflation has had the opposite effect. If we have seen the peak in inflation, that is a good thing. But two questions remain: how long will it take for inflation to come down, and where will it bottom out? The CPI number reported in November was 7.7%. The Fed target is 2%. That’s a big gap to close, and the Fed has indicated it will do ‘whatever it takes’. Fed Chair Jerome Powell may prove to be more Grinch than Santa.

“My goal is to have everyone agree with me … later.”

James Grant – Grant’s Interest Rate Observer

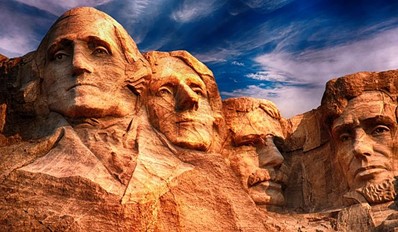

Crypto Coal – Just as I once believed in a jolly guy in a red suit, lots of folks recently believed in a chubby guy in a T-shirt (photo here). Last month, the $32 billion FTX cryptocurrency group headed by 30-year-old Sam Bankman-Fried filed for bankruptcy, thus leaving coal in many crypto stockings. Bankman-Fried, aka SBF (there was a time when only presidents—FDR, JFK, LBJ—were known by their initials) was a modern-day pied piper who convinced numerous consenting adults (celebrities, athletes, and politicians included) that his FTX operation was a money machine. The smart guys knew better (fun video here).

One investor who ended up being a goat was Tom Brady, the ‘GOAT’ quarterback of the NFL’s Tampa Bay Buccaneers. November was a rough month for Mr. Brady. Not only had his team lost to the lowly Carolina Panthers—not only had his supermodel wife filed for divorce—but it was reported that his millions invested in Bankman-Fried’s FTX group evaporated overnight. Tom Brady is used to a game defined by ‘three Rs’ – rules, regulations, and referees. The crypto game is questionable on the first, and devoid of the last two. I’m guessing that Tom will still be throwing touchdowns, that women will be coming at him like a Dallas Cowboys’ blitz, and that he still has a few million tucked away somewhere. May I offer a suggestion, Mr. Brady? Raymond James. The name is on your Tampa Bay stadium. And much like your game, our game has rules, regulations, and referees. Whatever you have left, give me a call.

Midterm Pivot? – It seems as though most people have grown weary of the belligerence and extremism in today’s politics. Last month, I happened to catch this refreshing interview (here) with Asa Hutchinson, the Republican Governor of Arkansas. Hutchinson is the epitome of character, competence, and civility. I believe these qualities matter. The reality is … they do.

Any opinions are those of James Aldendifer and not necessarily those of RJFS or Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. Investing involves risk and you may incur a profit or loss regardless of the strategy selected.