Mid-year report

Doug Drabik discusses fixed income market conditions and offers insight for bond investors.

From the peak of interest rates in October 2023, the market sensed the end of Federal Reserve rate hikes. July 2023 was the last of their 11th rate hike totaling 525 basis points. The timing played a profound role in the 2024 economic predictions. At the beginning of 2024, many pundits earmarked 5 to 6 Fed rate cuts for 2024 starting in March. Economic activity was foretold to slow at the very least, develop into a mild recession, or become a full-blown recession in the more extraordinary forecasts. Inflation was to drop to below 2.5% if not to the Fed’s 2% target.

In fairness, these predictions were all over the board and forecasting is an inexact science. The 2024 consensus, however, was for a distinct slowdown in economic activity and lower interest rates led by a series of Fed rate cuts. We also are only halfway through the year so a lot remains to be seen going forward into the 3rd and 4th quarter. My view has been and continues to be a little outside the box. I believe that we are experiencing a general commonplace economic cycle but that it is not unfolding at the pace the market anticipates it should. We are emerging from a very extraordinary circumstance in the pandemic. Businesses were shut down and unprecedented government aid, backstops, debt deferral/forgiveness, and money infusions have held the economy up. Full employment and wage increases allowed consumer spending to remain resilient which also aided in deferring a recession. The yield curve remains inverted but its predictive consistency should not be ignored. Recessions typically occur months after the curve reverts to a normal slope.

The midyear report card is good (for the economy, not for pundit/investor predictions). GDP has remained strong. Steady high employment and wage increases have allowed consumer spending to stay resilient and thus have been translated into strong corporate earnings. Consumers have performed their role in sustaining the economy. Both the S&P and Dow Jones Industrial Average are hovering around historic highs. Raised housing prices have given consumers a sense of inflated wealth.

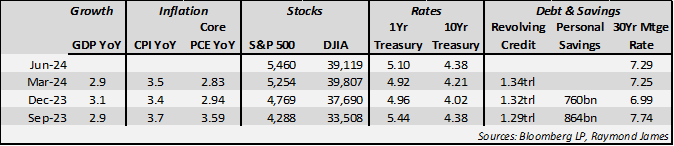

The gross domestic product measures the final market value of goods and services produced and as indicated in the chart, it has held up, undeniably beating expectations and inspiring optimism. The wealth effect is more than psychological. Investors in the stock markets have benefitted from soaring stock prices. Investors buying individual bonds have gained an advantage with purchases that will benefit from elevated income returns.

So what’s not to like? Inflation has stubbornly held well above the Fed’s 2% goal. But it goes much deeper than the latest inflation data release. The surge and continued elevated price increases are beginning to change consumer behavior. If inflation is going down it does not mean that prices go down. It merely means that prices are not increasing at as fast a pace. The average consumer is stuck with the higher prices that this inflationary period has produced – and barring an extended deflationary period, could likely remain forever.

The final section of the chart expresses part of the scope of worry. Huge consumer savings that were built during the pandemic have been depleted and then some. The general consumer savings balance is below long-term averages. Worse, consumer debt is at historic levels. Housing has been brought to its knees with high mortgage rates keeping homeowners with low mortgage rates locked into their current homes, and potential buyers unable to afford swollen mortgage payments created by elevated rates.

The economic cycle is methodically moving forward as it always does. Eventually the economy will slow down, the Fed will reverse policy, and interest rates will follow downward. However, this still hasn’t occurred and so obtaining elevated income remains an encouraged strategy. Interest rates are as high as they have been in over 17 years. Since January, we have encouraged investors to capitalize by locking into higher rates for longer – for as long as your risk tolerance will allow you. At some point in the future, investors will look back at this moment in time and realize the opportunity at hand. Lock into growth-like returns in more conservatively structured individual bonds.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Investment products are: not deposits, not FDIC/NCUA insured, not insured by any government agency, not bank guaranteed, subject to risk and may lose value.

To learn more about the risks and rewards of investing in fixed income, access the Financial Industry Regulatory Authority’s website at finra.org/investors/learn-to-invest/types-investments/bonds and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) at emma.msrb.org.