Money Meditations

Jack Hallier

Financial Advisor

SOMETHING WORTH WRITING ABOUT

“The utility resulting from any small increase in wealth will be inversely proportionate to the quantity of goods previously possessed.”

~Daniel Bernoulli 1723

"Interest rates are to asset prices like gravity is to the apple. They power everything in the economic universe."

~Warren Buffet

The quote above is taken from Peter Bernstein’s classic book on risk, ‘Against the Gods. In the history of understanding ‘risk taking’ Bernoulli’s insight was groundbreaking because it combined the objective (probability and math) and the subjective (intuition and feelings) in evaluating risk. In economic terms Bernstein states, “…then the disutility caused by a loss will always exceed the positive utility provided by a gain of equal size.” In simpler terms, pain is more powerful than pleasure; fear is more impacting than greed.

The financial world spends a lot of effort pursuing the holy grail of better investing. There are many intelligent people and many thoughtful strategies underlying this effort. Ultimately, the pursuit is a balance and comparison between the pursuit of capital creation (equity) through cash flow profits (value investing) or the creation of revenue streams in the pursuit of a better tomorrow (growth investing) AND the comparison of these investments to a more stable, less risky alternative, i.e., credit or interest rate investments.

For the period 1926 - 2022, capital creation by US Small Stocks as represented by Ibbotson Small Cap Index, averaged 11.80% and US Large Stocks as represented by the S&P 500 averaged approximately 10.1% annually. Stable alternatives (interest rate credit) represented by long-term by 20-year Government Bonds and short-term by US T-Bills earned 5.20% and 3.20%. respectively. (Source: Morning Star Ibbotson IBBI 2023)

A US $1.00 invested at the beginning of the period grew to $49,052 in US Small Stocks, $11,535 in Large Stocks, $131.00 in 20-year Government Bonds and $22.00 in 30-day T-Bills. (Source: Morning Star Ibbotson IBBI 2023) In the long-term it appears the investing decision is simple. Buy stocks they will make more money (creation vs lending; equity vs debt). A lot more money!

And yet, something must be missing because not everyone owns all stocks (or real estate or commodities) and no credit investments. The missing element is obviously risk, i.e., the threat of loss or harm.

For our purposes here, risk is losing money. It could be a temporary loss where the price goes down before it goes back up. It could be permanent where the loss is 100% of our investment, never to be recovered. And it could be the ‘lost opportunity’ of our capital by investing in one choice instead of another.

A permanent loss is typically considered in the form of a bankruptcy where a company goes out of business, or a real estate investment is taken into bankruptcy and surrendered to lenders. However, a temporary loss can become permanent if one sells an investment during a temporary decline and never reinvests.

Underlying risk and return are a fundamental behavioral issue that all investors have to manage.

How comfortably uncomfortable are you with uncertainty versus certainty?

These 9 words are the ultimate test of your actions when risk (pain) is more present than return (pleasure). And for most investors is the comparison of expected, but unknown, future equity returns with the expected, and known, future returns on most interest rate related credit investments.

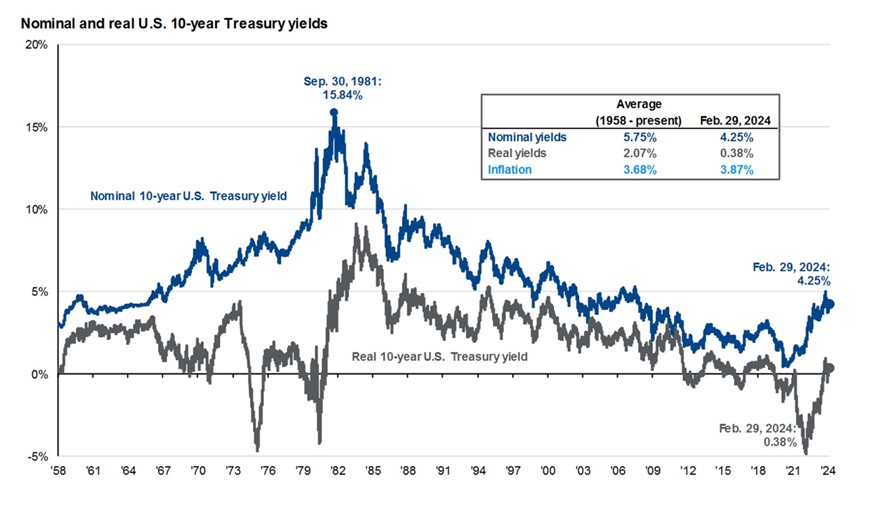

The relationship of expected returns of equity investments vs interest rate credit investments is not a constant. And neither is the expected risk relationship a constant. The underlying causes of the current price and expected future value of equity investments and the rate of interest earned on credit investments is multi-faceted, dynamic, and rarely in ‘equilibrium’. A review of a chart of the returns of the S&P 500 on an annual basis or the graph of interest rates in this issue’s Every Picture Tells a Story provides evidence that neither move in a straight line from year to year.

Where are we today in this relationship between more speculative equity prices and the certainty of fixed income returns?

This relationship has changed significantly in the last 24 months. Interest rates, as represented by the Fed Funds rate, have risen from near 0% to 5.30% in 2 years. Interest rates have not seen these levels for 15 years. (Source: FRED St. Louis FED)

Equity valuations at any point can be quite diverse if comparing varying securities, sectors, indexes, etc. However, due to interest rates declining to almost 0%, equity prices in general increased significantly for many years (not in a straight line) through 2023. Why? Because if the expected future return of credit investments was near 0% investors chose to buy other investments, e.g., stocks, real estate, commodities, digital currency, art, etc. where the chance of earning more than 0% existed.

In general, due to declining interest rates the current valuations of equity investments are above the median range of their historical valuation range. As always, some specific securities and sectors are better valued than others. However, the relationship of the expected returns for interest rate credit investments vs equities has improved considerably, notably in the last 12 months, e.g., 2 years ago the expected range of return between equity and interest credit related investments may have been 6-10% for equity vs 0-3% for credit. Whereas today the range may be 6-9 for equities vs 5-8% for debt investments. (Source: Vanguard Capital Market assumptions). And the range of results for credit is more certain than that of equities. This change in the return/risk relationship is significant and unique given the last 10-15 years of economic and market behavior.

Comfortable vs uncomfortable; certain vs uncertainty

What does all this mean? First, the financial repression of lower interest rates that has made it difficult to make money for conservative investors has improved. Second the improved risk/return relationship of fixed income makes balanced portfolios look more attractive for the moderate risk investor. Third if one was considering a lower risk level, for any reason, rebalancing to fixed income is prudent and more profitable than it has been for many years.

SOMETHING WORTH READING

(This is a lengthy article, but my most quoted and referenced in 2023.)

Howard Marks - Sea Change

sea change (idiom): a complete transformation, a radical change of direction in attitude, goals . . . (Grammarist)

In my 53 years in the investment world, I’ve seen a number of economic cycles, pendulum swings, manias and panics, bubbles and crashes, but I remember only two real sea changes. I think we may be in the midst of a third one today.

As I’ve recounted many times in my memos, when I joined the investment management industry in 1969, many banks – like the one I worked for at the time – focused their equity portfolios on the so-called “Nifty Fifty.” The Nifty Fifty comprised the stocks of companies that were considered the best and fastest-growing – so good that nothing bad could ever happen to them. For these stocks, everyone was sure there was “no price too high.” But if you bought the Nifty Fifty when I started at the bank and held them until 1974, you were sitting on losses of more than 90% . . . from owning pieces of the best companies in America. Perceived quality, it turned out, wasn’t synonymous with safety or with successful investment.

Meanwhile, over in bond-land, a security with a rating of single-B was described by Moody’s as “failing to possess the characteristics of a desirable investment.” Non-investment grade bonds – those rated double-B and below – were off-limits to fiduciaries since proper financial behavior mandated the avoidance of risk. For this reason, what soon became known as high yield bonds couldn’t be sold as new issues. But in the mid-1970s, Michael Milken and a few others had the idea that it should be possible to issue non-investment grade bonds – and to invest in them prudently – if the bonds offered enough interest to compensate for the risk of default. In 1978, I started investing in these securities – the bonds of perhaps America’s riskiest public companies – and I was making money steadily and safely.

In other words, whereas prudent bond investing had previously consisted of buying only presumedly safe investment grade bonds, investment managers could now prudently buy bonds of almost any quality as long as they were adequately compensated for the attendant risk. The U.S. high yield bond universe amounted to about $2 billion when I first got involved, and today it stands at roughly $1.2 trillion.

This clearly represented a major change in direction for the business of investing. But that’s not the end of it. Prior to the inception of high yield bond issuance, companies could only be acquired by larger firms – those that were able to pay with cash on hand or borrow large amounts of money and still retain their investment grade ratings. But with the ability to issue high yield bonds, smaller firms could now acquire larger ones by using heavy leverage, since there was no longer a need to possess or maintain an investment grade rating. This change permitted, in particular, the growth of leveraged buyouts and what’s now called the private equity industry.

However, the most important aspect of this change didn’t relate to high yield bonds, or to private equity, but rather to the adoption of a new investor mentality. Now risk wasn’t necessarily avoided, but rather considered relative to return and hopefully borne intelligently. This new risk/return mindset was critical in the development of many new types of investment, such as distressed debt, mortgage-backed securities, structured credit, and private lending. It’s no exaggeration to say today’s investment world bears almost no resemblance to that of 50 years ago. Young people joining the industry today would likely be shocked to learn that, back then, investors didn’t think in risk/return terms. Now that’s all we do. Ergo, a sea change.

Here is a link to the full article: Sea Change (oaktreecapital.com)

Here is a follow up Marks has provided since the original was written. Further Thoughts on Sea Change (oaktreecapital.com)

EVERY PICTURE TELLS A STORY

"The most important item over time in valuation is obviously interest rates…If I could only pick one statistic to ask you about the future before I gave the answer, I would not ask you about GDP growth. I would not ask you about who was going to be president, or a million other things. I would ask you what the interest rate is going to be over the next 20 years on average."

~Warren Buffet

A 36,000-foot view of interest rates (and inflation) over the last 66 years.

GETTING PERSONAL

LOVE, WISDOM AND JOYWATCH:

- Reacher on Prime Video. Doesn’t take itself too seriously but a lot of fun.

- Beckham on Netflix. Even if you aren’t the biggest soccer fan, it’s hard not to like this short 4-episode docuseries.

LISTEN TO:

- Shostakovich: “Piano Concerto No. 2 in F Major, Op. 102, II Andante”

- Chris Stapleton’s “White Horse”.

READ:

- The Accidental Superpower; Twelve Years On”, by Peter Zeihan – how America came into greatness.

- 12 Rules of Life, by Jordan B. Peterson – An intellectual thinker that invites you to get more out of life.

- The Defining Decade, by Meg Jay – A must read for any 20 something’s or those soon approaching.

Connect, Contact…

*Raymond James & Associates, Inc, member New York Stock Exchange/SIPC

*The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, and is not a recommendation. There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct.

*Examples included are hypothetical for illustration purposes only.

*One cannot invest directly in an index. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Ibbotson Small Cap Index is defined as a broad cross-section of U.S. small companies on a market-cap weighted basis. The fund’s target buy range includes those companies whose market cap falls in the lowest 5% of the market universe defined as the aggregate of the NYSE, NYSE AMEX, and NASDAQ.

*Views expressed are the current opinion of the author, but not necessarily those of Raymond James. The author’s opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security. Information contained in this report was received from sources believed to be reliable, but accuracy is not guaranteed.

*There is no assurance any investment strategy will be successful. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Past performance may not be indicative of future results. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small- and mid-cap securities generally involve greater risks and are not suitable for all investors. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Individual investor’s results will vary.

*This information contains forward-looking statements about various economic trends and strategies. You are cautioned that such forward-looking statements are subject to significant business, economic and competitive uncertainties and actual results could be materially different. There are no guarantees associated with any forecast and the opinions stated here are subject to change at any time and are the opinion of the individual strategist. Data comes from the following sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, the Federal Reserve Board, and Haver Analytics. Data is taken from sources generally believed to be reliable, but no guarantee is given to its accuracy.

*Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize, or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any web site or the collection or use of information regarding any web site’s users and or/members.

*Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and federally registered CFP (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s Initial and ongoing certification requirements.

Insights & Discovery