Raymond James Financial: Company History

In 1962, Bob James set out to build a different kind of financial services firm.

In the years since, that firm has grown to become a leader in its industry, dedicated to and driven by a focus on independence, integrity, conservative risk management and always putting clients first.

In the years to come, we’ll work to carry our success – and Bob’s legacy – to new heights.

“We are in a people business, inside as well as out.”

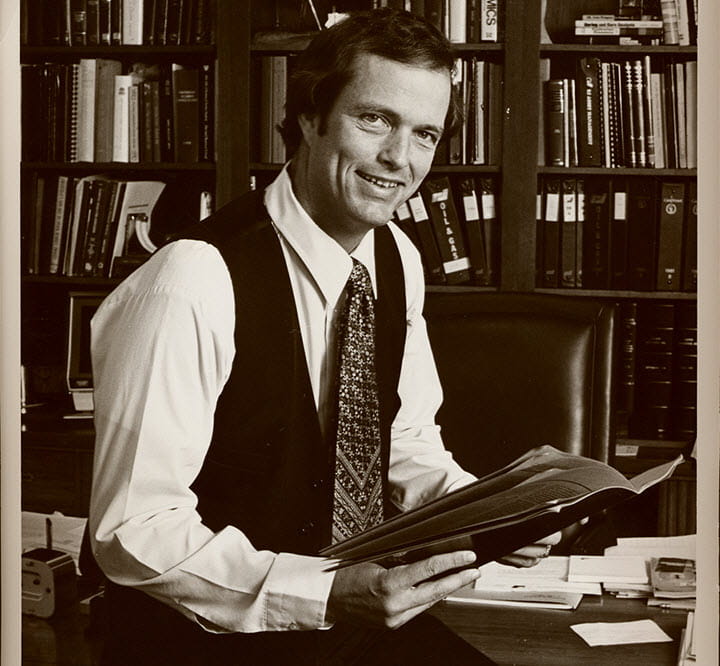

Tom James, the son of co-founder Bob James, joined the firm fresh out of Harvard Business School. Within a few short years, Raymond James had moved its client-first practice into an 8,000-square-foot office.

Our firm takes its first steps, incorporating as Robert A. James Investments.

Edward Raymond sells Raymond and Associates to Bob James, with the agreement that Bob will name the new firm Raymond James & Associates. Soon after, Ed suffers a near-fatal car accident and never joins the firm. Bob, however, insists on keeping Ed’s name on the door, ahead of his own.

Bob brings his brother Roy James on board to establish the firm’s Marketing department.

The Dow Jones Industrial Average closes at 838.92, and Raymond James reports revenue of $3.3 million.

Bob James’ son Tom joins the firm full time.

We expand our capabilities with the formation of the firm’s Investment Banking division.

From humble beginnings in an apartment building on 3rd Avenue N., we graduate to an 8,000-square-foot space on downtown St. Petersburg’s Central Avenue.

We continue expanding our offerings with the establishment of a general insurance agency, known today as Raymond James Insurance Group.

Investment Management & Research, Inc. (IM&R), later part of Raymond James Financial Services, is formed to engage in investment banking activities and reaches the $1 million revenue mark.

The firm opens specialist operations on the Philadelphia Stock Exchange to support institutional clients.

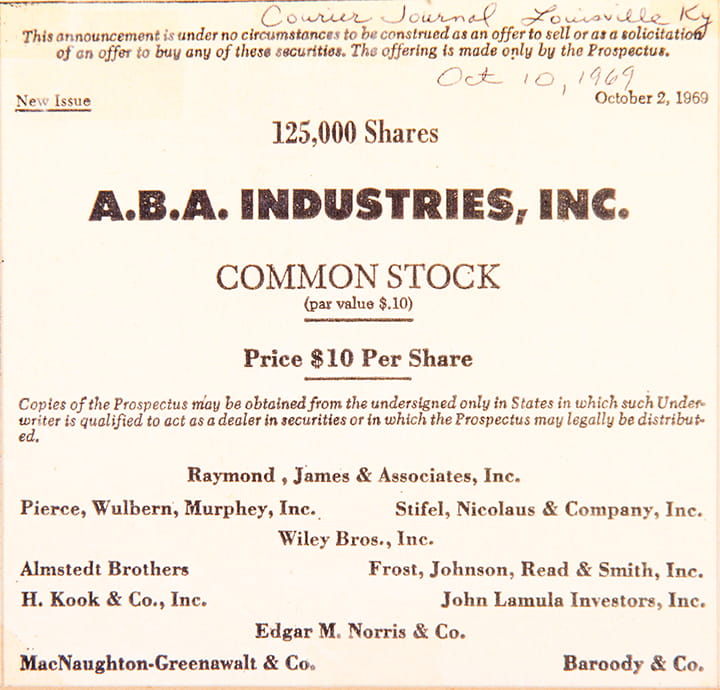

Our first successful stock underwriting, for ABA Industries, is complete.

Raymond James Financial officially incorporates as a holding company.

The firm files for an initial public offering with the SEC, but market conditions put the move on hold.

Raymond James begins recruiting from top business schools to support ambitious growth objectives.

“As my father always said, ‘It’s all about the people.’ If you don’t have the best people, if you don’t constantly refresh your universe of people by bringing in new talent and motivating those already here, then you can’t be successful in the long run.”

Tom James, the son of founder Bob James, was named CEO at the start of the decade, and in 1973 Raymond James gained a seat on the New York Stock Exchange, helping to ensure the best execution for clients.

After deciding to devote his time to serving individual clients and training financial advisors, Bob James names his son Tom CEO.

The firm’s first computers are introduced to improve the efficiency of day-to-day operations.

The Dow Jones Industrial Average closes at 858.71, and Raymond James reports revenue of $6.2 million.

We again expand our offerings as the Equity Research department begins operations.

To help ensure the best execution for clients and to reflect the firm’s growth, Raymond James & Associates gains a seat on the New York Stock Exchange.

The firm begins offering formal classroom training to associates, leading to the formation of Raymond James University.

During the economic downturn of 1973 and 1974, with the survival of the firm in the balance and capital reserves dwindling, Tom James sells off portions of his prized rare coin collection to help keep our doors open.

Investment Management & Research (IM&R) reactivates as an independent contractor broker/dealer.

Raymond James acquires Financial Service Corporation and folds it into IM&R, forming the first large-scale network of independent financial advisors.

The firm begins offering correspondent clearing services to independent broker/dealers.

Raymond James Asset Management, later Eagle Asset Management and today one of the firms that make up Carillon Tower Advisers, is formed.

Financial Planner magazine names Bob James the most prolific leader of financial planning seminars in history.

“It all begins with listening to people and accurately assessing their true financial needs.”

But bigger events were in store. In 1983, Raymond James celebrated a day many years in the making as the company went public with a $14-million initial public offering. While that celebration was both delayed and dampened by the untimely death of the firm’s founder Bob James in May of the same year, the firm’s employees were heartened by the strong future built on the father of financial planning’s legacy.

Raymond James surpasses $1 million in net income for the first time.

Robert Thomas Securities is formed as an independent contractor broker/dealer.

Herb Ehlers takes the reins at Raymond James Asset Management, which in 1984 he renames Eagle Asset Management.

The Dow Jones Industrial Average closes at 1546.67, and Raymond James reports revenue of $81.2 million.

Raymond James founder Robert A. “Bob” James dies. His legacy was not only a firm focused on financial planning, but a people-centered approach to business that inspired those who knew him.

After a 14-year delay, Raymond James goes public with a $14-million initial public offering.

The firm’s stock is listed on the NASDAQ.

The firm spends Presidents Day weekend moving into new headquarters on 66th Street in St. Petersburg.

Our offices on 66th Street in St. Petersburg.

Raymond James pays its first dividend.

The New York Stock Exchange approves Raymond James stock for listing under ticker symbol RJF.

With this certificate, our NYSE stock listing is official.

We complete construction of Tower 1 of the Raymond James Financial Center, located in the Carillon office park on 15 acres of former swampland.

A bird’s-eye view of our Carillon campus.

On October 19, 1987, known as “Black Monday,” the stock markets experience a dramatic plunge that prompts many firms to shut down their trading desks and turn off their phones to minimize losses. Raymond James refuses to do the same. Our desks stay open to help meet clients’ needs, resulting in our first and only unprofitable quarter since the firm went public in 1983.

Raymond James associates prove they’re made of sturdy stuff, and garner international notice, when they endure an eight-day air conditioning outage – and 90◦+ temperatures – with panache.

Our air conditioning outage makes headlines.

Our research and asset allocation results make their national debut in The Wall Street Journal.

“The fact is that commitment to clients and commitment to financial advisors is sacrosanct.”

In 1994, Raymond James Bank was founded as a savings and loan association, enhancing the firm’s offerings to include the benefits of a national charter for advisors and client.

Our corporate culture and long-held commitment to client service is codified and given a name: Service 1stSM.

The Dow Jones Industrial Average closes at 3,168.83, and Raymond James reports revenue of $554.1 million.

Our newest subsidiary, Raymond James Trust Company, forms.

The firm publishes the Client Bill of Rights, penned by CEO Tom James, which sets the standard for our industry.

The Raymond James Client Bill of Rights.

Raymond James Bank is founded as a savings and loan association to offer the benefits of a national charter and to provide even more resources to advisors and their clients.

Raymond James Network for Women Advisors makes official debut.

The Dow Jones Industrial Average hits 5,000 for the first time.

The firm takes another step into the digital age, offering clients access to their account information on raymondjames.com.

Raymond James International Holdings, Inc. is established, expanding international operations and bolstering the firm’s presence in cities like Paris and Geneva, Switzerland (offices established in 1987 and 1988, respectively).

Raymond James Bank completes nationwide introduction of residential lending products.

Raymond James becomes the title sponsor of the Gasparilla Festival of the Arts, which has been held in Tampa since 1970.

The firm purchases the naming rights to Tampa’s new stadium, and the Bucs help christen Raymond James Stadium® with a win over the Chicago Bears.

Raymond James Stadium’s opening day, September 20, 1998.

Our independent contractor subsidiaries IM&R and Robert Thomas Securities merge to form Raymond James Financial Services.

We begin offering online trading to clients through their financial advisors.

We make our most significant acquisition to date with the addition of Detroit-based regional broker/dealer Roney & Co.

The Dow Jones Industrial Average hits 10,000 for the first time.

“The best way to ensure the firm’s long-term success is to focus primarily on our clients’ needs.”

Our conservative nature once again serves our clients when we experience one of the worst recessions in our country's history. The firm survives without financial assistance from Congress, relying instead on our own revenue, our dedicated advisors and our clients' continued trust.

The firm partners with Killik & Co. to launch a new brokerage firm in the United Kingdom – Raymond James Killik Limited (later Raymond James Investment Services Limited) – to provide financial planning and investment services through independent contractor financial advisors.

Raymond James Financial Services celebrates its 25th anniversary.

Raymond James acquires Canadian firm Goepel McDermid to form Raymond James Ltd.

Raymond James Stadium plays host to Super Bowl XXXV and the Baltimore Ravens’ defeat of the New York Giants.

The Financial Institutions Division completes the acquisition of Legg Mason’s small division that provides securities services to banks.

Raymond James is honored with the national Business in the Arts award.

Construction is completed on the fourth tower of the Raymond James Financial campus.

Governor Jeb Bush and the Florida Cabinet recognize Tom James as the 2004 Florida Free Enterpriser of the Year.

The firm purchases a 38,000-square-foot space in Southfield, Michigan, to serve as an operations center and business continuity hub.

Tom James is appointed chairman-elect of the Financial Services Roundtable.

In a survey of local business leaders featured in the St. Petersburg Times, the firm receives recognition for quality of associates and excellent client service.

Raymond James hosts its first annual Analyst & Investor Day.

Tom James is named Ernst & Young’s National Entrepreneur of the Year in the financial services category.

Raymond James survives the recession without financial assistance from Congress, relying instead on our own revenue, our dedicated advisors and our clients’ continued trust.

Raymond James Stadium hosts its second Super Bowl – Super Bowl XLIII, where the Pittsburgh Steelers triumph over the Arizona Cardinals.

We bolster our mergers and acquisitions business with the acquisition of Lane Berry & Co., a middle market investment banking and advisory firm.

“This really is a client-first, long-term-focused organization. It’s something that’s been woven into our core values from the beginning, and something we take great pride in.”

The same year, the firm positioned itself for the future, joining forces with Morgan Keegan to become one of the nation’s largest wealth management and investment banking firms not located on Wall Street.

After 40 years as CEO, Tom James is succeeded by Paul Reilly. Tom remains Chairman of the Board.

Financial Planning pays tribute to Tom, his ongoing work and his lasting legacy.

The firm launches a new national branding campaign in print, broadcast and online, anchored by a tagline that gets to the heart of what we do: Life Well Planned.

Raymond James celebrates 50 years of caring for people and their financial well-being.

Raymond James and Morgan Keegan unite to become one of the largest wealth management and investment banking firms in the country not headquartered on Wall Street.

In an effort to expand our banking efforts north of the border, the firm moves to acquire the Canadian assets of Allied Irish Banks.

Raymond James achieves its 100th consecutive quarter – and 25th year – of profitability.1

1Awards Criteria.

Executive Chairman Tom James is named one of five recipients of the annual Harvard Business School Alumni Achievement Award, the school’s highest honor.

Our former Global Private Client Group CEO Chet Helck marks the end of his tenure as chairman of the Securities Industry Financial Markets Association, where, among many accomplishments, he played an instrumental role in creating the “Helping Americans Succeed, Helping Main Street Prosper” campaign.

Global Private Client Group CEO Chet Helck retires and per the firm’s management succession plans, Scott Curtis and Tash Elwyn join the firm’s Executive Committee.

Raymond James Bank marks its 20th anniversary with assets exceeding $12 billion.

Raymond James is honored with the Golden Hammer Award and named Habitat Partner of the Year by Habitat for Humanity of Pinellas County.

To strengthen our business continuity and digital security efforts, the firm constructs a state-of-the-art facility and relocates our data center to Denver.

Raymond James completes the acquisition of The Producers Choice, LLC, a private insurance and annuity marketing company, and its 60 associates become part of Raymond James Insurance Group.

The Dow Jones Industrial Average closes at 17168.61, and Raymond James reports record annual revenue of $5.2 billion and record net income of $502.1 million.

The Tampa Bay Buccaneers will continue to call Raymond James Stadium home as the firm signs a new agreement to extend its naming rights through the 2027 season.

Raymond James expands its investment banking capabilities in Europe with the purchase of Munich-based M&A advisory Mummert & Company Corporate Finance GmbH.

MacDougall, MacDougall & MacTier Inc. (3Macs), which was founded in 1849 before Canada’s Confederation and remains one of the country’s leading independent investment firms, is acquired by our Canadian subsidiary, Raymond James Ltd.

The firm completes the acquisition of the U.S. private client unit of Deutsche Asset and Wealth Management and revives the storied Alex. Brown brand.

CEO Paul Reilly adds the responsibilities of Chairman to his role when Tom James becomes Chairman Emeritus, retaining a seat on the board.

Raymond James is selected to be a part of the S&P 500® index.2

2Awards Criteria.

Scout Investments and its Reams Asset Management division are acquired by our asset management subsidiary, Carillon Tower Advisers.

St. Petersburg Mayor Rick Kriseman joins Chairman & CEO Paul Reilly and Chairman Emeritus Tom James at our corporate headquarters to officially open Tower 5.

Chairman and CEO Paul Reilly is inducted into the Tampa Bay Business Hall of Fame.

Chairman Emeritus Tom James is honored as an Industry Champion at the SIFMA Foundation Tribute Dinner.

After more than 32 years as our Chief Financial Officer, Jeff Julien announces his retirement effective January 1, 2020. In accordance with the firm’s succession plans, the firm’s treasurer and senior vice president of finance and investor relations, Paul Shoukry, will become CFO.

“We have something special here at Raymond James, where we have the scale and scope of services to compete with the largest firms in the industry while at the same time providing an advisor- and client-focused culture that is increasingly difficult to find.”

The new decade began with a year of incredible challenges, including the COVID-19 pandemic, economic uncertainty and social unrest across the nation. The response of the firm’s associates and advisors during this time of crisis reinforced Raymond James’ unique culture.

Raymond James donates $1.5 million to aid those impacted by the COVID-19 pandemic.

Raymond James acquires retirement administration firm NWPS and boutique investment bank Financo.

The Dow Jones closes the year at 30,606.48, and Raymond James surpasses $1 trillion in client assets under administration.

Raymond James Stadium hosts its third Super Bowl – Super Bowl LV, where the Tampa Bay Buccaneers triumphed over the Kansas City Chiefs.

Raymond James acquires private equity advisor Cebile Capital.

Raymond James acquires fixed income market maker SumRidge Partners, banking and investment firm TriState Capital and U.K.-based wealth management firm Charles Stanley.

Raymond James celebrates 60 years of putting clients first.